Current Affairs August 03, 2023: Article 370, Child Labor Prevention, Caste-Based Survey, National Register of Citizen, Delimitation Draft, GST

Subscribers of "Current Affairs" course can Download Daily Current Affairs in PDF/DOC

Subscribe to Never Miss an Important Update! Assured Discounts on New Products!

Must Join PMF IAS Telegram Channel & PMF IAS History Telegram Channel

{GS2 – Empowerment – Children – 2023/08/03} Child Labor Prevention

- Context (PIB): As per National Crime Records Bureau (NCCB), 613 cases were registered in 2021 under Child and Adolescent Labour (Prohibition and Regulation) Act, 1986.

Child Labour Laws in India

- Factories Act, 1948: It prohibits the employment of children below the age of 14 years in factories.

- The Mines Act, 1952: It prohibits the employment of children below the age of 18 years in mines.

- Right To Education Act, 2009: It provides free, compulsory education to all children aged 6 to 14.

- Child Labour (Prohibition and Regulation) Amendment Act, 2016: It prohibits

- the employment of children below 14 years and

- the employment of adolescents (14-18 years) in hazardous occupations.

National Child Labour Project (NCLP) Scheme

- It is a Central Sector Scheme under the Ministry of Labour and Employment (MoL&E).

- In 2016, the NCLP scheme was merged with Samagara Shiksha Abhiyan (SSA) Scheme (MoE).

Objectives

- To eliminate all forms of child labour.

- To identify and withdraw all adolescent workers from Hazardous Occupations.

- To create awareness amongst stakeholders, target communities, etc., on child labour issues.

- To create a monitoring, tracking and reporting system against Child Labour.

Target Groups

- All child workers below 14 years of age in the identified target area

- Adolescent workers below 18 years of age and engaged in hazardous work

- Families of Child workers in the recognised target area.

Mandate

- Children aged 5-8 years must be mainstreamed into the formal educational system through the Samagra Shiksha Abhiyaan.

- Children aged 9-14 years must be withdrawn from work and put into NCLP Special Training Centers (STCs) to prepare them for the formal education system.

- Adolescent workers below the age of 18 years in the target area engaged in hazardous occupations are withdrawn from work and provided skills through existing schemes for skill development.

Project Implementation

- District Project Societies (DPS) are set up at the district level under the Chairmanship of the District Magistrate for the implementation of the project.

Funding pattern

- GoI provides 100% of the funding.

- Funds are released directly to the registered NCLP District Project Society.

PENCIL (Platform for Effective Enforcement for No Child Labour) Portal

- It is an electronic platform launched in 2017 for the effective implementation of the NCLP scheme and to establish a child labour-free nation.

- It connects the central government to the state government, district administration, civil society and the general public to achieve the target of a child labour-free society.

- It provides a platform for all to raise a complaint against child labour.

Constitutional Provisions For Child Upliftment

|

{GS2 – Polity – IC – 7th Sch – 2023/08/03} HC Allows Caste-Based Survey by Bihar

- Context (TH): The Bihar Government conducted a caste-based survey in January 2023.

- On May 4, the Patna HC stayed the caste-based census in its interim order.

- On Aug 1, the Patna HC upheld the caste-based survey and allowed its continuation as it is aimed at Development with Justice.

Grounds on which the petition was filed in the HC

Right to privacy

- The petitioners argued that the right to privacy of those surveyed would be infringed due to the queries concerning their religion, caste, and monthly income.

- The HC reiterated that permissible restrictions could be imposed on the fundamental right, in the state’s legitimate interests, provided they are proportional and reasonable.

- It clarified that the data is being collected to identify the economic, educational and other social aspects of different communities which require further action by the State for their upliftment.

Powers of the state to carry out such a survey

- The petitioner argued that Entry 69 of the Union List of Seventh Schedule of IC contains the Centre’s exclusive power to conduct a census.

- However, Entry 45 of the Concurrent List confers power to both Centre and the states to collect statistics for any matter listed in List II and III of the Seventh Schedule.

- Entry 20 of the Concurrent List provides for economic and social planning.

The Seventh Schedule of the IC

Census and Caste data

Socio Economic and Caste Census (SECC)

|

{GS2 – Polity – IC – Citizenship – 2023/08/03} National Register of Citizen (NRC)

- Context (TH): The United Naga Council has asked the Manipur government to start the exercise to update the NRC. It fears the influx of people from Myanmar will create a severe demographic crisis.

- The National Register of Citizens (NRC) was born from independent India’s first census in 1951.

- It is the register containing the names of Indian citizens.

- All States were mandated to compile an NRC, but it was done only in Assam.

Citizenship (Amendment) Act, 1986 and Assam

- The fear of the indigenous people being outnumbered by illegal immigrants during and after the 1971 Bangladesh War led to the Assam Agitation from 1979 to 1985.

- The demand for updating the 1951 NRC to eject foreigners was raised during the agitation.

- The agitation ended with the signing of the Assam Accord in August 1985.

- The accord prescribed March 24, 1971, the eve of the Bangladesh War, as the cut-off date for detecting, detaining and deporting foreigners.

- Accordingly, the 1986 Amendment to the Citizenship Act created a special category of citizens in relation to Assam.

Conditions for Citizenship

- To include the name in the NRC (Assam), one needs to show a link to a family member’s name.

- This family member must be in the 1951 NRC or any state electoral roll before March 24, 1971.

- If the applicant’s name is not on these lists, he can produce any of the twelve other notified documents dated up to March 24, 1971.

SC’s order to complete the NRC

- In 2013, the SC ordered to complete the exercise by December 31, 2017.

- On July 31, 2019, the final NRC was released.

- Nineteen lakh people were excluded from the final draft.

- Foreigners’ tribunals were set up to listen to the appeals of the excluded people.

Citizenship Law for Assam vs the Rest of India

- The Citizenship Act of 1955 prescribes five ways of acquiring citizenship — birth, descent, registration, naturalisation, and incorporation of territory.

- To determine citizenship by birth, there are cutoff dates for the country, which are different for Assam, where the NRC is being prepared.

- A person born in India on or after January 26, 1950, but before July 1, 1987, is a citizen of India by birth, irrespective of the nationality of his parents. This does not apply to Assam.

SC’s stand

- The SC rejected a plea to include as citizens those born in Assam, India, between March 24, 1971, and July 1, 1987, unless they had ancestral links to India.

- In any other Indian state, they would have been citizens by birth.

National Population Register (NPR)

NPR vs NRC

|

{GS2 – Polity – IC – Elections – 2023/08/03} Delimitation draft

- Context (IE): Assam’s opposition parties are protesting against EC’s draft delimitation document.

- The delimitation of constituencies in Assam was last done in 1976, based on the 1971 census. Hence the number of seats in the Lok Sabha/Assembly is not adjusted to reflect the population growth.

- The EC has proposed to retain the number of seats but to make changes to the geographical boundaries of the constituencies and the number of reserved seats for STs and SCs.

- EC proposals met with controversy from the Bengali-origin Muslim community, who allege partisan draft, depriving political representation.

- Delimitation in Assam is a complex issue with valid concerns. A fair and transparent process is essential to ensure representation of all communities.

Delimitation

- Delimitation means the act or process of fixing limits or boundaries of territorial constituencies in a country to represent population changes. Delimitation is done for:

- Ensuring equitable representation for all segments of a population.

- Promoting equitable distribution of electoral districts to prevent partisan advantage.

- Upholding the principle of One Vote, One Value.

Delimitation Commission (DC/Boundary Commission)

- The DC is set up by an act of the Parliament and is appointed by the President.

Functions

- Establishing proportional constituency sizes and boundaries to achieve population equality between constituencies.

- Designating reserved seats for SCs and STs in areas with a significant SC/ST population.

Members of the Delimitation Commission (DC)

- President appoints the DC, which cooperates with the Indian Election Commission and consists of:

- A retired judge of the Supreme Court

- Chief Election Commissioner (Ex officio member)/Election Commissioner nominated by CEC

- State Election Commissioners (of the respective states) – Ex-officio members

Orders of the Delimitation Commission (DC)

- The DC’s delimitation orders have the force of law and cannot be questioned before any court.

- The copies of its orders are laid before the House of the People and the State Legislative Assembly concerned, but no modifications are permissible therein by them.

- These orders come into force on a date specified by the President of India on DC’s behalf.

Issues with Delimitation Commission

- Despite the 2002-2008 Delimitation process being based on the 2001 census, the total number of seats in the Assemblies and Parliament, determined by the 1971 Census, remained unchanged, leading to a mismatch between population data and representation.

- The constitution sets a maximum limit of 550 seats for the Lok Sabha and 250 seats for the Rajya Sabha, which means that rapidly growing populations are being represented by a single representative, potentially diluting their representation.

- The disparity in population control efforts among states leads to unequal representation in Parliament, with states showing less interest in population control, potentially getting more seats.

- Southern states that have actively promoted family planning may face the possibility of having their parliamentary seats reduced, thus diminishing their political influence.

Why the Delimitation in Assam now?

- Arunachal Pradesh, Nagaland, Assam and Manipur were left from the delimitation process in 2002-08 because of protests due to the pending National Register of Citizen (NRC) process.

- In 2008, after the President had deferred delimitation in these states, Parliament decided that the EC would conduct the exercise instead of creating another Delimitation Commission.

- RPA was amended, and Section 8A was introduced to give the EC’s new assignment legal validity.

- In 2020, the then President, Ram Nath Kovind, repealed the deferment order of 2008.

- In 2020, the government constituted a DC headed by a former SC judge to redraw Lok Sabha and assembly constituencies of J&K, Assam, Arunachal Pradesh, Manipur and Nagaland.

Additional ReadingArticle 82 of the Indian Constitution

87th Amendment Act of 2003

Section 8A of RPA, 1950

|

Future Delimitation and its Potential Impact

- The share of the southern states in India’s population has drastically come down from 24.8% in 1971 to 19.9% in 2021, while for UP and Bihar, it has gone up from 23% to 26%.

- The future exercise to delimit parliamentary constituencies could deepen the north-south divide in terms of political representation, weakening the South’s political influence further.

Way forward

- A equal voice in a democracy is vital, but recognising the regional balance of power and contributions and taking everyone along is also essential in a federal structure. For example, the USA gives all states the same number of seats in one parliament chamber.

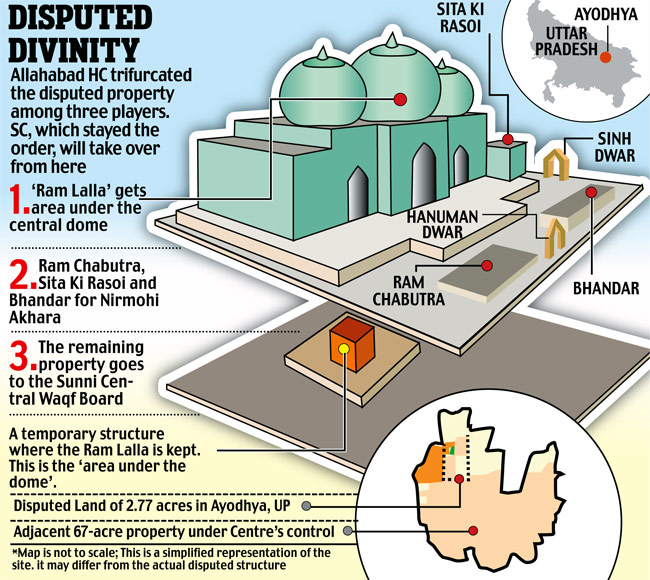

{GS2 – Polity – IC – Fedaralism – 2023/08/03} Article 370, Legal?

- Context (IE I HT): SC began hearing the constitutional challenge to the 2019 abrogation of Article 370, which granted special status to J&K.

Background

- J&K was a princely state ruled by the Jamwal Rajput Dogra Dynasty from 1846 to 1947.

- During the Partition of India in 1947, Maharaja Hari Singh of J&K tried to negotiate with India and Pakistan to have an independent status for his state.

- He offered the proposal of a Standstill Agreement to both dominions, pending a final decision on the state’s accession. Pakistan accepted the offer, but India did not.

- On Oct 22, 1947, Pakistan broke the agreement by sponsoring a tribal militant attack in Kashmir.

- India assured help on the condition that Hari Singh should sign the Instrument of Accession.

|

- Maharaja Hari Singh signed the instrument of accession with India on October 26, 1947.

- It was agreed that once the situation is normalised, the views of the J&K people would be ascertained about their future.

Article 370 of the Indian Constitution

- Article 370 had been described as a tunnel through which the Constitution was applied to J&K.

- Article 370 is the first article of Part XXI of the IC (Temporary, Transitional & Special Provisions).

- It exempted the state from the application of the Indian Constitution, except for Article 1 (which defines India as a union of states) and Article 370 itself.

- It allowed the state to draft its constitution.

- For extending a central law on subjects included in the Instrument of Accession, mere ”consultation” with the state government was needed.

- But for extending it to other matters, “concurrence” of the state government was mandatory.

Presidential Order – 1954

- By the 1954 order, almost the entire Constitution was extended to J&K including most Constitutional amendments (with some exceptions).

Key provisions of the 1954 Order

- Indian citizenship was extended to the permanent residents of J&K.

- The fundamental rights of the IC were extended to the state.

- The jurisdiction of SC was extended to the State.

- The power to declare a national emergency in the event of external aggression was given to the Central Government.

Article 35A

|

Abrogation of Article 370

- Article 370 was altered on August 5, 2019, by the President of India through a Presidential Order.

- It bifurcated the state of Jammu and Kashmir into two UTs: Jammu & Kashmir and Ladakh.

|

Legal Aspects

- Article 370 was intended to be temporary until Kashmir’s Constitution was drafted, and the Constituent Assembly of J&K had the power to recommend its abrogation to the President.

- The Constituent Assembly of J&K, however, dissolved itself in 1957 without making any recommendation for amendment or abrogation.

- SC has ruled on multiple occasions that Article 370 is a permanent part of IC since the only body that could have abrogated it has been dissolved without doing so.

Legal standpoint

- Article 370(1)(d) mentions that the President has the power to modify the Constitution to make it applicable to J&K.

- Article 367 was modified accordingly (as it applies to J&K) through a Presidential order which required that the ‘Constituent Assembly’ in Article 370(3) be read as the J&K Assembly!

- This way, The President has attempted to amend Article 370 indirectly.

- Therefore, the IC, as it applies to J&K now has two provisions that say contradictory things.

- Article 370(3) says that the Constituent Assembly of J&K can recommend the abrogation of Article 370. (But it was dissolved in 1957)

- Article 367(4)(d) says that Constituent Assembly must be read to mean J&K Assembly!

- The Presidential Order enables President to do indirectly what he cannot do directly, i.e. amending Article 370 through Article 367 because he has no power to amend Article 370 directly.

- The President has exceeded the confines of the power delegated to him under Article 370(1)(d).

Rule: Breaking the door to enter the house is illegal. Loophole: Okay then, we will break the wall and enter the house! Or better, we will install a new door on the broken wall and then open it legally. SC: Please wait!

Article 367 and J&K

|

Which provision should prevail?

- Principles of Statutory Interpretation require that the meaning of a provision must be derived from its wording unless it is unclear.

- An interpretation clause cannot override the precise meaning of the actual provision, i.e., Article 367(4)(d) cannot override Article 370(3).

- In the Keshavananda Bharati case, which established the Basic Structure doctrine, i.e., a constitutional functionary cannot use the powers given to him under the Constitution to do what the Constitution never intended for him to do.

Abrogation Of Article 370 under President Rule

- The Presidential Order is also problematic because J&K was under President’s Rule.

- The requirement of obtaining the concurrence of the J&K Assembly was therefore dispensed with.

- Taking Such a Decision under President’s Rule in a State was considered a breach of India’s commitment to federalism.

President’s order, altering Article 367 is legal, is a matter of ongoing legal debateIn favour of the legality

Against

|

{GS3 – IE – Taxes – Indirect – 2023/08/03} Goods and Services Tax (GST)

- Context (TH | IE): GST Council decided to levy a uniform 28% tax on full face value for online gaming, casinos and horse racing.

- GST was introduced in 2017 by the 101st Constitutional amendment act of 2016.

- The amendment was passed under Article 368 of IC. As mandated by Article 368, GST Bill was passed by the Parliament by a special majority and ratified by more than half of the states.

- As per the GST Act, The Central Government has enacted:

- Central GST (CGST) Act.

- Integrated Goods and Services (IGST) Act which is applicable to interstate transactions.

- GST (Compensation to States) Act 2017 to compensate for the revenue shortfall of the States.

- Every State Government has enacted State GST (SGST) Act in their respective States.

|

GST Council

- Goods and Services Tax Council is a constitutional body established under Article 279A.

Structure of GST Council

- The Goods and Services Tax Council shall consist of the following members:

- Chairperson: The Union Finance Minister.

- Member: The Union Minister of State in charge of Revenue or Finance.

- Members: The Minister in charge of Finance or Taxation or any other Minister nominated by each State Government (States and UTs with legislature).

- Quorum: One-half of the Members of the GST Council shall constitute the quorum at its meetings.

- Voting weightage:

- Central Government has a voting weightage of one-third of the total votes cast, and

- The votes of all the State Governments taken together shall have a weightage of two-thirds of the total votes cast in that meeting.

- Every decision of the GST Council shall be taken at a meeting, by a majority of not less than three-fourths of the weighted votes of the members present and voting.

The Mandate of GST Council

- The GST Council shall make recommendations to the Union and the States. These include:

- Tax rates under GST.

- Any special rate or rates for a specified period to raise additional resources during any natural calamity or disaster.

- Model GST Laws.

- The goods and services that may be subjected to or exempted from the GST.

- The threshold limit of turnover below which goods and services may be exempted from GST.

- The date on which the goods and services tax be levied on petroleum crude, high-speed diesel, motor spirit (petrol), natural gas and aviation turbine fuel.

- To establish a mechanism to adjudicate any dispute.

- Any other matter relating to the goods and services tax, as the Council may decide.

GST Compensation Cess

- It is levied in addition to GST on notified goods, mostly in the luxury and demerit categories.

- The objective of levying this cess is to compensate the states for the loss of revenue arising due to the implementation of GST on 1st July 2017 for a period of five years or such period as recommended by the GST Council.

- Centre collects GST compensation Cess in the Consolidated Fund of India and then transfers it to GST Compensation Fund under the Public Account of India and then it goes to States Consolidated Fund.

- In 2022, GST Council extended the compensation cess period till March 2026.

- The collection will be used purely to repay the back-to-back loans taken between 2020-21 and 2021-22 and not to further compensate states.

|

GST appellate tribunal

- Despite five years since the introduction of GST, the GST Appellate Tribunal has not been set up.

- Currently, taxpayers aggrieved by adverse orders passed by the authorities are compelled to approach High Courts for redress.

- An expeditious constitution of an appropriate appellate structure in the form of National and Sub-national Benches of the Tribunal is the need of the hour.

- GST Council, in its 50th meeting, decided to put out the framework for setting up a GST appellate tribunal for resolving GST-related litigation.

Recent Changes

- 5% GST on pre-packed, labelled food items: Earlier, 5% GST was applied on pre-packed branded items (listed). Now it applies to all pre-packed and pre-labelled items (listed).

- Earlier National Anti-Profiteering Authority (NAA) was dealing with GST-related complaints like reduction in GST rates not passed to consumers or input tax credits availed by a registered GST entity not resulting in a commensurate reduction in the price of the product.

- In December 2022, NAA was abolished, and the Competition Commission of India (CCI) was given the task of NAA.

- GoI brought the GST Network (GSTN) under the purview of the Prevention of Money Laundering Act (PMLA), administered by the Enforcement Directorate (ED).

- It means that those who pay GST can now be prosecuted by ED under PMLA.

Tax on online gaming

- As per the new Govt. Tax (TDS) law, effective from April 1, 2023, TDS is being deducted at 30% of the taxable amount (Net winning) at the time of withdrawal.

- GST Council imposed a 28% GST on funds that online gaming companies collect from their customers. It clarified that 28% GST would be applicable on the actual cash or equivalent deposits made by players and not on the winning amounts they redeployed.

- If a bet is placed for, say, Rs. 1,000, and the player wins Rs 300, and if the player again places a bet of Rs 1,300, then GST will be levied only on the initial deposit of Rs. 1000 and not on on the winning amount of Rs 300, which is redeployed.

- Until now, the companies paid a small tax on the fee they charged. The change announced will impose a 28% tax on the amount collected from players in every game.

{Prelims – IR – India-US – 2023/08/03} Yudh Abhyas

- Context (TP): Yudh Abhyas is scheduled in Alaska from September 25 to October 8.

- Yudh Abhyas, 2023 is the 19th edition of the joint exercise conducted annually between the armies of India and the United States.

- A joint exercise near the LAC in Auli, Uttarakhand, was conducted last year.

- Yudh Abhyas has been ongoing since 2004 and is designed to promote cooperation between the two militaries while sharing training, cultural exchanges, and building joint operating skills.

- The training schedule focuses on employing an integrated battle group under Chapter VII of the UN Mandate.

- This includes all peacekeeping and peace enforcement operations and Humanitarian Assistance and Disaster Relief (HADR) operations.

{Prelims – Sci – Bio – 2023/08/02} Roundworms Resurrected Using Cryptobiosis

- Context (IE | IE | TG | WION): Scientists resurrected frozen microscopic nematodes (roundworms) in Siberia, which were frozen since the late Pleistocene era.

- They survived so long by entering a state called cryptobiosis.

- They belong to a previously unknown species called Panagrolaimus kolymaensis.

- These worms produce a sugar called trehalose, which helps them survive harsh drying/freezing.

Cryptobiosis

- Cryptobiosis is a biological phenomenon in which an organism enters a state of extreme dormancy in response to adverse environmental conditions.

- Using this phenomenon, organisms can withstand harsh conditions such as extreme temperatures, and desiccation (drying out) for extended periods (years or decades).

- During cryptobiosis, the organism’s metabolic processes slow down to an almost undetectable level, preserving its cellular structures and preventing damage.

- Organisms exhibiting cryptobiosis include tardigrades (water bears), rotifers, some plants and seeds, etc.

Significance of the Study of Cryptobiosis

- The study will show how animals can adapt to habitat change caused by climate change at a molecular level and survive.

![PMF IAS Environment for UPSC 2022-23 [paperback] PMF IAS [Nov 30, 2021]…](https://pmfias.b-cdn.net/wp-content/uploads/2024/04/pmfiasenvironmentforupsc2022-23paperbackpmfiasnov302021.jpg)