Current Affairs August 02, 2023: AQI, Hazardous Wastes Rules, Fiscal Deficit and FRBM Act, Akira Ransomware

Subscribers of "Current Affairs" course can Download Daily Current Affairs in PDF/DOC

Subscribe to Never Miss an Important Update! Assured Discounts on New Products!

Must Join PMF IAS Telegram Channel & PMF IAS History Telegram Channel

{GS3 – Envi – Air Pollution} Air Quality Monitoring

- Context (PIB): Delhi records its lowest average Air Quality Index (AQI) during July 2023 compared to the corresponding period of the last 04 years from 2019.

National Air Quality Monitoring Programme

- The Central Pollution Control Board (CPCB) has been executing a nationwide ambient air quality monitoring programme known as National Air Quality Monitoring Programme (NAMP).

- NAMP network comprises 800+ operating stations covering 344 cities/towns in 28 states and 6 UTs.

- NAMP is undertaken to determine the status and trends of ambient air quality, ascertain the compliance of NAAQS, identify non-attainment cities, etc.

- Under NAMP, Sulphur Dioxide (SO2), Oxides of Nitrogen (NO2), Respirable Suspended Particulate Matter (PM10) and Fine Particulate Matter (PM2.5) are regularly monitored.

- The monitoring of wind speed and direction, relative humidity and temperature were also integrated with the monitoring of air quality.

National Ambient Air Quality Standards (NAAQS)

- NAAQS are standards for air quality set up by CPCB in 2009.

- The CPCB has been conferred this power by the Air (Prevention & Control of Pollution) Act, 1981.

- NAAQS consists of twelve pollutants.

|

National Ambient Air Quality Standards, as of 2009 |

|||

| Pollutants (12) | Time Weighted

Average |

Concentration in Ambient Air |

|

| Industrial, Residential, Rural & Other Area | Ecologically Sensitive Area (notified by GOI) | ||

| SO2, μg/m3 | Annual | 50 | 20 |

| 24 hours | 80 | 80 | |

| NO2, μg/m3 | Annual | 40 | 30 |

| 24 hours | 80 | 80 | |

| PM10, μg/m3 | Annual | 60 | 60 |

| 24 hours | 100 | 100 | |

| PM2.5, μg/m3 | Annual | 40 | 40 |

| 24 hours | 60 | 60 | |

| O3, μg/m3 | 8 hours | 100 | 100 |

| 1 hour | 180 | 180 | |

| Lead (Pb), μg/m3 | Annual | 0.50 | 0.50 |

| 24 hours | 1 | 1 | |

| CO, mg/m3 | 8 hours | 2 | 2 |

| 1 hour | 4 | 4 | |

| Ammonia (NH3), μg/m3 | Annual | 100 | 100 |

| 24 hours | 400 | 400 | |

| Benzene, μg/m3 | Annual | 5 | 5 |

| Benzopyrene, μg/m3 | Annual | 1 | 1 |

| Arsenic (As), ng/m3 | Annual | 6 | 6 |

| Nickel (Ni), ng/m3 | Annual | 20 | 20 |

Air Quality Index

- AQI was launched in 2014 with an outline ‘One Number – One Color – One Description’ for the common man to judge the air quality within his vicinity.

- It has been developed by Central Pollution Control Board (CPCB).

- AQI is based on eight pollutants, namely:

- Particulate Matter (PM10)

- Particulate Matter (PM2.5)

- Nitrogen Dioxide (NO2)

- Sulphur Dioxide (SO2)

- Carbon Monoxide (CO)

- Ozone (O3)

- Ammonia (NH3)

- Lead (Pb)

- AQI has six categories of air quality.

2021 WHO Air Quality Guidelines (AQGs)

WHO Ambient Air Quality Database

Fifth update (2022)

|

{GS3 – Envi – Hazardous Waste} Hazardous Wastes Rules, 2016

Hazardous Wastes (Management and Handling) Rules, 2016

- The 2016 Rules has been enacted to promote recycle and reuse of waste while reducing hazardous wastes.

Other Wastes

- These rules have been made to distinguish between hazardous Waste and other wastes.

- Other wastes include waste tyres, paper waste, metal scrap, used electronic items, etc. and are recognised as a resource for recycling and reuse.

Standardisation of Steps of Waste Management by Occupier

- The 2016 Rules standardised the sequence of priority in which the occupier must manage waste.

- The sequence is prevention > minimization > reuse > recycling > recovery, utilisation (including co-processing) > safe disposal.

Standard Operating Procedures (SOPs)

- The rules established the fundamental requirement of infrastructure and SOPs to protect human health and the environment from hazardous waste, specific to the waste type.

- These SOPs must be complied with by the stakeholders and verified by SPCB/PCC.

Rules for the Import/Export of Waste

- No country can export hazardous waste to India for final disposal.

- This means that India only imports hazardous wastes to recycle, reuse or for other utilisation.

- The rules specify the procedure for importing and exporting hazardous waste to and from India.

- Exporters of silk waste have now been exempted from requiring permission from MoEF.

- Electrical and electronic components manufactured in and exported from India, if found defective, can now be imported back into the country without obtaining permission from MoEF.

- Industries that do not require consent under the Water (Prevention and Control of Pollution) Act 1974 and the Air (Prevention and Control of Pollution) Act 1981 are now exempted from requiring authorisation also under the Hazardous and Other Wastes Rules, 2016.

Wastes Prohibited for Import

- Waste edible fats and oil of animals or vegetable origin

- Household waste

- Critical care medical equipment

- Tyres for direct re-use purpose

- Solid Plastic waste, including Pet bottles

- Waste electrical and electronic assemblies scrap

- Other chemical wastes, especially in solvent form

Duties Assigned to State Governments for Waste Management

- States should establish/allocate industrial space or sheds for recycling, pre-processing, and other utilisation of hazardous or other waste and register the workers involved in recycling.

- States must undertake skill development activities and ensure the safety and health of workers.

- The state governments have to submit an annual report to the MoEFCC.

- SPCBs must prepare an annual inventory of the waste generated, recycled, recovered, and utilised (including co-processed) and submit it to the CPCB.

Treatment, Storage and Disposal Facility for Hazardous Wastes

- 2016 rules give a clear direction of how the treatment, storage and disposal facility is to be established. Permission from the SPCB is required for the layout in this regard.

Packaging, Labelling and Transport of Hazardous and Other Wastes

- CPCB provides extensive guidelines for packaging and labelling.

- If the waste is to be transported to a facility in a different state for its final disposal, a ‘No Objection Certificate’ is required on the sender’s part from the SPCBs of both states.

Amendment of 2019

- Amendment has been made considering the “Ease of Doing Business” and boosting the “Make in India” initiative by simplifying the procedures under the Rules while simultaneously upholding the principles of sustainable development and ensuring minimal impact on the environment.

{GS3 – Envi – Hazardous Waste} Toxic Waste at Bhopal Disaster Site

- Context (TH): CPCB report submitted to the NGT states that hazardous waste stored on the Union Carbide India Limited (UCIL) premises is yet to be disposed of.

|

Bhopal Gas Tragedy

- Bhopal gas tragedy (or Bhopal disaster) occurred in 1984 in Bhopal, Madhya Pradesh.

- It resulted from a massive leak of methyl isocyanate (MIC) gas from the Union Carbide India Limited (UCIL) pesticide plant owned by the American MNC, Union Carbide Corporation.

|

Aftereffect of the Bhopal Tragedy

- The tragedy claimed thousands of lives and left countless with severe injuries and health issues.

- Locals are still facing health issues because of the leak. It includes stillbirth, congenital malformations, respiratory and neurological issues, etc.

Legislations After Bhopal Gas Tragedy

- After the Bhopal gas tragedy, a series of legislations were enacted to prevent the occurrence of such disasters in the future and to provide legal safeguards to the victims of such disasters.

Bhopal Gas Leak Disaster (Processing Of Claims) Act, 1985

- It confers certain powers on the central government to secure the claims of the Bhopal gas leak disaster victims.

Environment (Protection) Act, 1986

- It authorises the GoI to take measures to protect and improve the environment.

- It includes the setting of standards and inspection of industrial units.

Hazardous Waste Management Rules, 1989

- These rules are notified to ensure safe handling, generation, processing, packaging, storage, transportation, use, collection, conversion, sale, destruction, and disposal of hazardous waste.

- These rules were amended, and the new rules are titled Hazardous And Other Wastes (Management and Transboundary Movement) Rules, 2016.

Public Liability Insurance Act, 1991

- It provided for public liability insurance for providing immediate relief to the persons affected by accidents occurring while handling any hazardous substance.

National Environment Appellate Authority Act, 1997

- It provided for the establishment of an appellate authority.

- This authority on appeal will decide where any industries, operations, or processes are restricted, subject to safeguards under the Environment (Protection) Act, 1986.

National Green Tribunal Act, 2010

- It provided for the establishment of a National Green Tribunal (NGT).

- This act has dissolved the National Environment Appellate Authority.

- India is the 3rd country to set up a specialised environmental tribunal after Australia and NZ.

National Green Tribunal (NGT)

- NGT was established in 2012 under the NGT Act (2010).

- Objective: To effectively and expeditiously dispose of cases related to environmental protection and conservation of forests and other natural resources.

- It is mandated to dispose of the appeals within 6 months of the filing of appeals.

- It has five places of sittings. New Delhi is the principal place of sitting, and Kolkata, Bhopal, Pune, and Chennai are the other four sittings.

National Green Tribunal > PMF IAS Environment 2nd Edition > Page 256

For All Environment Related Laws > PMF IAS Environment 2nd Edition > 245-267

Authorities in India for Regulating Hazardous Waste

|

{GS3 – IE – Budget} Fiscal Deficit and FRBM Act

- Context (BT): India’s April-June Fiscal Deficit widens to 25.3% of the annual target.

- The Centre’s target is to continue the path of fiscal consolidation (fix high deficits/debt) and lower its fiscal deficit from 6.4% of the GDP in 2022-23 to 5.9% in 2023-24 and 4.5% by 2025-26.

Types of Deficit

|

Type of Deficit |

Formula |

| Budget Deficit | Budget Deficit = Total Expenditure – Total Revenue |

| Revenue Deficit | Revenue Deficit = Total Revenue Expenditure – Total Revenue |

| Fiscal Deficit | Fiscal Deficit = Total Expenditure – (Total Revenue – Borrowings)

Fiscal Deficit = Budget Deficit + Borrowing |

| Primary Deficit | Primary Deficit = Fiscal Deficit – Interest Payments |

| Effective Revenue Deficit | Effective Revenue Deficit = Revenue Deficit – Grants for Capital Assets |

- Budget Deficit: the government spends more money than it collects in taxes and revenue.

- Revenue Deficit: the government spends more money on its revenue-generating activities, such as tax collection, than it collects in revenue from those activities.

- Fiscal Deficit: the government spends more money on all of its activities, including both revenue-generating and non-revenue-generating activities, than it collects in revenue from all sources.

- Primary Deficit: the government spends more money on all of its activities, excluding interest payments, than it collects in revenue from all sources.

- Effective Revenue Deficit: the govt spends more money on its revenue-generating activities, excluding grants for the creation of capital assets, than it collects in revenue from those activities.

Merits and Demerits of Fiscal Deficit on the Economy

| Merits | Demerits | ||

| Stimulates economic activity |

Leads to inflation |

||

|

Increases investment |

Increases interest rates |

||

| Supports social welfare programs |

Reduces investor confidence |

||

| Acts as a countercyclical policy |

Crowds out private investment |

||

| Supports long-term investment |

Leads to unsustainable debt |

Steps Taken By Government To Achieve Fiscal Consolidation

Reducing government spending

- This can be done by cutting back on non-essential spending, such as subsidies and transfers.

- The government has reduced the subsidy for food, fertiliser and petroleum.

|

Increasing government revenue

- This can be done by broadening the tax base (equitable sharing of burden) and raising tax rates (leads to more brain drain).

- Goods and Services Tax (GST), which was implemented in 2017, has broadened the tax base and increased tax revenue.

Capital Expenditure (for building capital assets that create wealth and boost growth)

- In the Budget for 2023-24, capital spending is planned to rise to 3.3% of GDP, and the government has provided an interest-free loan of ₹1.3 lakh crore for 50 years to states to boost growth.

Selling assets

- GoI has taken up disinvestment of Air India and other loss-making PSEs to raise revenue.

Fiscal Responsibility and Budget Management Act, 2003

- FRBM Act aims to ensure a balance between Government revenue and government expenditure.

- The objectives of the act are:

- Fiscal discipline.

- Efficient management of expenditure, revenue and debt.

- Macroeconomic stability.

- Better coordination between fiscal and monetary policy.

- Transparency in the fiscal operation of the Government.

- It set deficit targets for Union and States to control their deficits.

- The target and parameter changed along with amendments in 2012, 2012, 2015 and 2018.

Figures as a percentage of GDP

Salient Features

- Section 4 (1) of the FRBM Act provides that the Central Government shall

- take measures to limit the fiscal deficit up to 3 per cent of GDP.

- endeavor to ensure that by the end of Financial Year 2024-25

- the General Government debt does not exceed 60 per cent of GDP.

- the Central Government debt does not exceed 40 per cent of GDP.

- not give additional guarantees with respect to any loan on security of the Consolidated Fund of India in excess of one-half per cent of GDP, in any Financial Year.

- endeavor to ensure that the fiscal targets are not exceeded after stipulated target dates.

- Under Section 5 of the Act, except for certain circumstances, the Act does not allow the Central Government to borrow from Reserve Bank of India (RBI).

- The FM shall review, on half-yearly basis, the trends in receipts and expenditure in relation to the budget and place before both Houses of Parliament the outcome of such reviews.

CAG Audit

- The 2012 Amendment prescribed for periodical review by the CAG of the compliance of the provisions of FRBM Act by the Government.

FRBM Review Committee headed by NK Singh

- The government believed the targets set by FRBM Act were too rigid.

- In 2016, the government set up a committee under NK Singh to review the FRBM Act.

- The committee recommended that the government should target a fiscal deficit of 3 percent of the GDP in years up to March 31, 2020, cut it to 2.8 per cent in 2020-21 and to 2.5 per cent by 2023.

- The Committee suggested using debt as the primary target for fiscal policy.

Targets set by NK Singh Committee:

- Debt to GDP ratio: The review committee advocated for a Debt to GDP ratio of 60% to be targeted with a 40% limit for the centre and a 20% limit for the states.

- Revenue Deficit Target: It should be reduced to 0.8% of GDP by March 31, 2023.

- The minimum annual reduction target was 0.5% of GDP.

- Fiscal Deficit Target: It should be reduced to 2.5% of GDP by March 31, 2023.

- The minimum annual reduction target was 0.3% of GDP.

FRBM Act – Escape Clause

- The FRBM Act was amended in 2018, adding Specific details that were given in Section 4(2).

- If the escape clause is triggered, RBI is then allowed to participate directly in the primary auction of government bonds, thus formalising deficit financing.

| Deficit financing refers to the method of financing the budget deficits — such as issuing bonds or printing more money. |

- FRBM Act Section 4(2), provides for a trigger mechanism to escape deficit control–related clauses in the act and the Government can over cross the targets in the following situations:

- National Security / Act of War

- National Calamity

- If agriculture output and farm incomes collapse

- Fall in real output/GDP growth rate beyond x%

- Structural reforms in the economy with unanticipated fiscal implications

- During the above trigger conditions

- The government may over cross/deviate from the fiscal deficit target by up to 0.5% of GDP, as recommended by NK Singh’s FRBM Review Committee

- Individual State Governments may also do similar (e.g. overcross by 0.5% of GSDP), after amending the state FRBM Act accordingly.

- Finance Minister cited structural reform to escape the FRBM targets for 2019-20 and 2020-21.

|

Key Terms related to the FRBM Act

- A gradual reduction in the fiscal deficit over time is known as Fiscal Glide.

- Fiscal profligacy is reckless extravagance or wasteful expenditure of public money.

- The failure to meet the government’s fiscal deficit target is known as fiscal slippage.

Documents Mandated by FRBM Act

- GoI must ensure greater transparency in its fiscal operation in the public interest.

- The documents that the government is required to present along with the budget are:

- Macroeconomic Framework Statement: This statement provides an overview of the economy, including GDP growth, inflation, receipts and expenditure.

- Medium-Term Fiscal Policy Statement: This statement sets out the government’s fiscal policy goals for the medium term.

- Fiscal Policy Strategy Statement: This statement explains how the government plans for fiscal policy goals.

- Medium-Term Expenditure Framework: This framework sets out the government’s spending plans for the medium term.

{GS3 – S&T – Cybersecurity} Akira Ransomware

- Context (IE | TH ): Computer Emergency Response Team of India (CERT-In) issued an alert for ransomware named “Akira”.

Malware (malicious software)

- Malware is any program (computer code)/file that is harmful to the user of an electronic device.

- Malware can monitor/steal/encrypt/alter/delete data and hijack core computing functions.

- Mobile malware can access the device’s components, such as the camera, microphone, GPS, etc.

How does malware enter a device?

- Malware can be delivered to a device with a USB drive or can spread over the internet through downloads, softwares, applications, etc.

- Phishing attacks are a common type of malware delivery where emails/SMS/Whatsapp messages disguised as legitimate messages contain malicious links/attachments that deliver the malware.

Different types of malware

- Virus: malware which can execute itself and spread by infecting other programs or files.

- Worm: self-replicating malware that typically spreads without any human interaction.

- Trojan horse: designed to appear as a legitimate program in order to gain access to a system. Once activated, Trojans can execute their malicious functions.

- Spyware: malware that collects data on the device and spy on activities of unsuspecting users.

- Ransomware: malware that infects a user’s system and encrypts the data. Cybercriminals then demand a ransom payment from the victim in exchange for decrypting the system’s data.

- Rootkit: malware created to obtain administrator-level access to the victim’s system. Once installed, the program gives threat actors root or privileged access to the system.

- Adware: malware used to track a user’s browser and download history with the intent to display pop-up or banner advertisements that lure the user into making a purchase.

- Keyloggers: also called system monitors, are used to see nearly everything a user does on their computer. This includes emails, opened web pages, programs and keystrokes.

Ransomware

- Ransomware encrypts the victim’s data or locks them out of their computer systems.

- The attackers then demand a ransom from the victim (usually payable in cryptocurrency like Bitcoin) in exchange for providing the decryption key or restoring access to the system.

- It typically spreads through phishing emails that contain malicious attachments.

- Ransomware attacks are a significant cybersecurity threat, causing disruptions, financial losses, and data breaches to individuals, businesses, and organisations worldwide.

How Akira Ransomware Works?

- Akira ransomware target both Windows and Linux devices.

- It uses Virtual Private Network (VPN) services to trick users into downloading malicious files.

- After infecting a sytem, it shuts down Windows services that restrict it from encrypting files.

- Once it steals/encrypts sensitive data, the group behind the attack extorts the victims for a ransom, threatening to release the data on their dark web blog.

|

Indian Computer Emergency Response Team (CERT-In)

- CERT-In is the national nodal agency to deal with cyber security threats like hacking and phishing.

- It is an office within the Ministry of Electronics and Information Technology (MeitY).

- It was formed in 2004 under Information Technology Act, 2000.

Practices Recommended by CERT-In Against Ransomware Attack

- Maintaining regular offline data backups which are encrypted.

- All accounts should have strong and unique passwords.

- Multi-factor authentication (verifying logins with SMS/Email OTP)

- Separate administrative network.

- A host-based firewall.

- Disable remote desktop connections.

- Spam-proof email validation system.

- Anti-virus software should be updated.

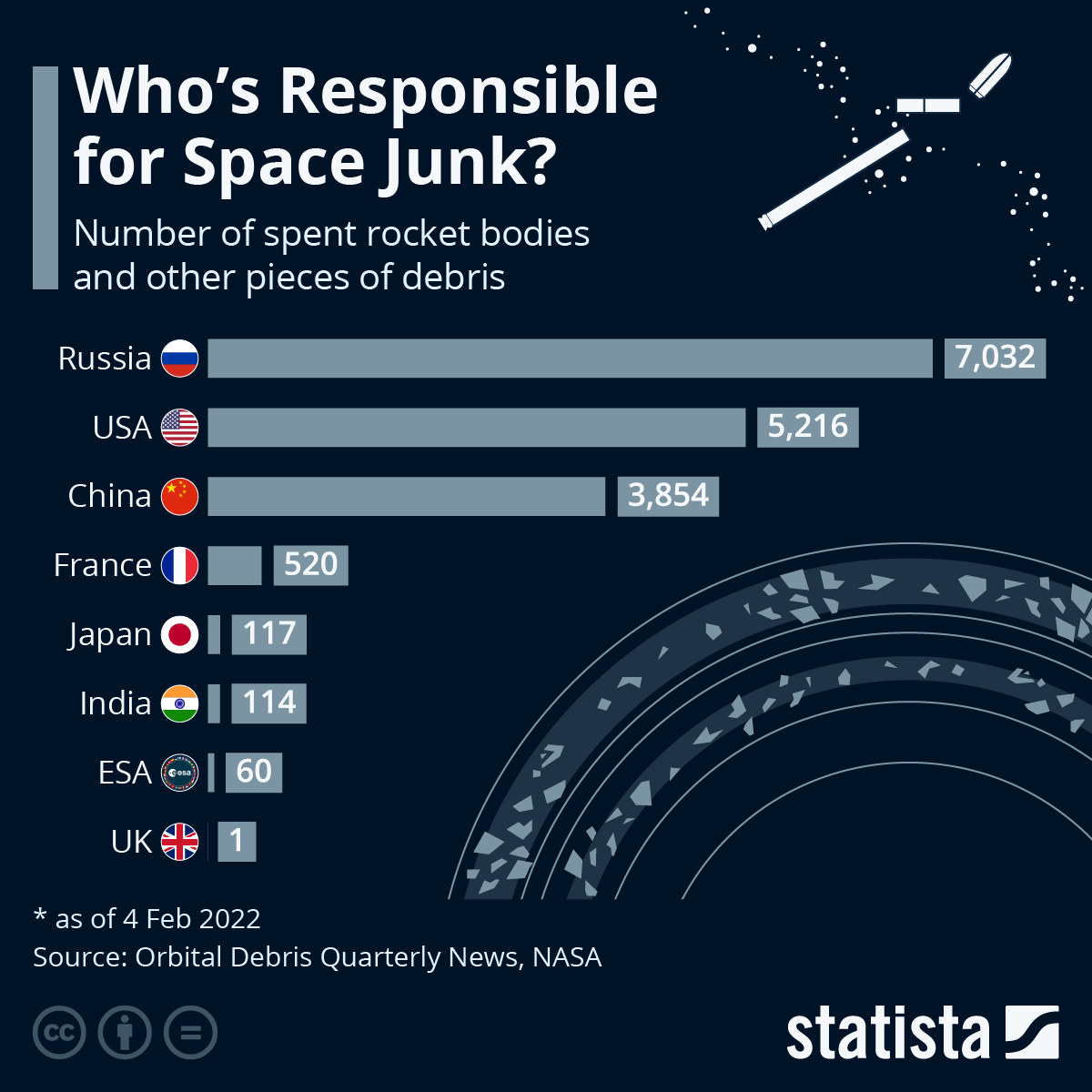

{GS3 – S&T – Space} PSLV C56 Mission

- Context (TH | LM ): During PSLV C56 mission, ISRO’s PSLV successfully placed seven Singaporean satellites into intended orbits.

Significance of PSLV C56 Mission

- PSLV C56 mission is the second commercial mission of ISRO’s NSIL.

- The mission is designed to mitigate the space debris problem.

Credits: Statistia

- Normally, after a successful mission, a rocket stays in orbit for “decades” as space debris, before re-entering into Earth’s atmosphere.

- But in this mission after placing customer satellites at an altitude of 536 km, the rocket will be lowered into a 300 km high orbit.

- Due to the orbit-lowering, the duration of space debris generated from this mission in space will be reduced to two months.

|

Polar Satellite Launch Vehicle (PSLV)

- PSLV is an indigenous expendable launch system developed in the 1990s by ISRO.

- It is called the ‘workhorse of ISRO’ because it has the highest number of successful launches

|

Orbits in which PSLV Places Satellites

Polar and Near Polar (e.g. sun-synchronous orbit) Lower Earth Orbits

- PSLV was developed to place satellites (mostly remote sensing satellites) in polar and near polar (e.g. sun-synchronous orbit) Lower Earth Orbits.

- E.g., Astrosat (India’s first space observatory)

Geosynchronous Transfer Orbits

- Initially PSLV was developed to place satellites only on Low Earth Orbits. But, in the last decade, PSLV was successful in sending several satellites also toward geosynchronous transfer orbits.

- E.g. Chandrayaan-1 (India’s first lunar probe) and Mars Orbiter Mission or Mangalyaan (India’s first interplanetary mission).

Stages of PSLV

- PSLV is a four stage launch vehicle.

- First stage and third stage are solid-fuelled stages.

- Second stage and fourth stage are liquid-fuelled stages.

- The second stage engine, Vikas, is a derivative of France’s Viking engine.

New Space India Ltd (NSIL)

- New Space India Ltd (NSIL) is a Public Sector Enterprise (under the Companies Act, 2013).

- It is under the administrative control of the Department of Space.

- It is the commercial wing of the ISRO.

- Objective: to commercially exploit the Research and Development work of the ISRO.

Space Business Activities of NSIL

- Owning satellites for Earth Observation and Communication applications.

- Building satellites and launching them as per demand.

- Providing launch services for satellite belonging to customer.

- Building launch vehicles through Indian Industry and Launch as per satellite customer requirement.

- Space-based services related to Earth Observation and Communication on a commercial basis.

- Satellite building through Indian Industry

- Technology Transfer to Indian Industry

- Marketing spin-off (commercial) technologies and products/services emanating out of ISRO.

{GS3 – S&T – Tech} National Deep Tech Startup Policy (NDTSP)

- Context (TH I PIB): The Draft National Deep Tech Startup Policy (NDTSP) is published by Principal Scientific Adviser.

|

- Deep Technology refers to innovations founded on advanced technological breakthroughs.

- The NDTSP is strategically formulated to stimulate innovation through the effective utilization of deep tech driven innovations.

- The goal is to ensure India’s global prominence in the deep tech value chain, with a specific focus on areas such as semiconductors, Artificial Intelligence (AI), and space technology.

- They have the potential to solve most pressing societal issues due to their disruptive nature.

What is the difference between a Deep Tech Startup and a Regular Tech Startup?

- The main difference between them is the nature of the technology involved.

- Deep tech startups use cutting-edge technologies which are in the early stages of development.

- They face more challenges than regular tech startups, such as the need for more funding and the difficulty of commercializing their products.

Challenges Faced by Deep-Tech Start-ups

- High cost in Research and Development.

- Long development timeline.

- Regulatory hurdles add to the cost and complexity of development and commercialization.

- The scarcity of talent, especially in early-stage startups.

- Competition from large companies.

- Uncertainty in demand and changes in Technology.

Some examples of deep tech startups in India and their applications

|

Artifical Intelligence is covered in July 2023 Current Affairs

{Prelims – World PIN – Indian Ocean} Australia’s Cocos (Keeling) Is.

- Context (TH): Australia’s Cocos Is. and Christmas Is. are strategically located near the world’s most important maritime choke points (strategic narrow routes) like the Malacca Strait.

- These islands are located closer to Indonesia than to Australia.

- The islands are strategically located, making them ideal for monitoring shipping traffic.

- The islands were used as a staging ground for the Australian military during World War II.

- They are close to the equator, which makes them ideal for refuelling aircraft and ships.

Great Coco Island of Myanmar and China’s Presence

|

![PMF IAS Environment for UPSC 2022-23 [paperback] PMF IAS [Nov 30, 2021]…](https://pmfias.b-cdn.net/wp-content/uploads/2024/04/pmfiasenvironmentforupsc2022-23paperbackpmfiasnov302021.jpg)