Study on High-Fat Sugar Salt (HFSS) Products

Subscribers of "Current Affairs" course can Download Daily Current Affairs in PDF/DOC

Subscribe to Never Miss an Important Update! Assured Discounts on New Products!

Must Join PMF IAS Telegram Channel & PMF IAS History Telegram Channel

- Context (TH): Niti Aayog’s study is interested in understanding the impact of imposing health taxes and warning labels on food products.

- Public health researchers recommend a 20% to 30% health tax on sugar, sugar-sweetened beverages (SSBs), and HFSS products in addition to the existing GST.

HFSS Products

- HFSS foods may be defined as foods (any food or drink, packaged or non-packaged) that contain low amounts of proteins, vitamins, phytochemicals, minerals, and dietary fibre but are rich in fat (saturated fatty acids), salt, sugar, and high in calories (Ministry of Women and Child Development).

Current tax rates

- Sugar: 18% GST, SSB: 28% GST and a 12% additional cess, HFSS: only 12% GST

- SSB tax rate is applied uniformly irrespective of the amount of sugar.

Observations of Study

- Bulk consumers (manufacturers) should be targeted rather than retail sales.

- The study includes all forms of refined, unrefined sugar and gur (brown cane sugar).

- Price elasticity metrics indicate that a 10-30% health tax on SSBs could decrease demand by 7-30%, while a similar tax on HFSS products might lead to a 5-24% decline.

- The study also recommends taxing artificial sweeteners to prevent switching to unhealthy alternatives.

|

Need of tax on HFSS products

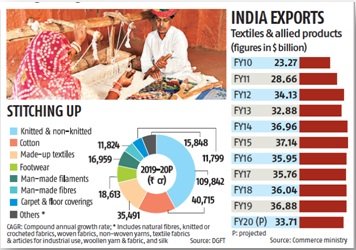

- India is facing a sugar epidemic, with a rise in all soft drinks sales by 24.8% from 2016 to 2019.

- The study remarked that a health tax can help control obesity and the risk of type 2 diabetes, cardiovascular disease, and certain cancers.

Current Initiatives

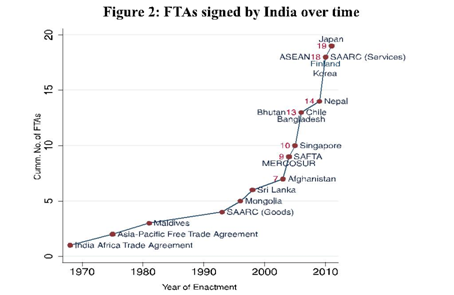

- Many Countries, including Mexico, Chile, and Argentina, have imposed a health tax on sugar, SSBs and HFSS.

- In Mexico, taxation on SSBs decreased consumption of taxed beverages in the first year of implementation and reduced mean BMI in younger age groups.

- Kerala introduced a ‘fat tax’, which later merged into India’s Goods and Services Tax in 2017.

![PMF IAS Environment for UPSC 2022-23 [paperback] PMF IAS [Nov 30, 2021]…](https://pmfias.b-cdn.net/wp-content/uploads/2024/04/pmfiasenvironmentforupsc2022-23paperbackpmfiasnov302021.jpg)