Current Affairs November 15-16, 2023: Ben Gurion Canal, Pradhan Mantri Particularly Vulnerable Tribal Groups (PM-PVTGs) Development Mission

Subscribers of "Current Affairs" course can Download Daily Current Affairs in PDF/DOC

Subscribe to Never Miss an Important Update! Assured Discounts on New Products!

Must Join PMF IAS Telegram Channel & PMF IAS History Telegram Channel

{GS2 – IR – Israel} Ben Gurion Canal

- Context (TH | IE): Israel, through the ‘Ben Gurion Canal,’ aims to eliminate Hamas in Gaza.

- Ben Gurion Canal is a proposed waterway through the Negev Desert in Israel, intended to create an alternative to the Suez Canal.

Significance

- It aims to challenge Egypt’s monopoly on the shortest route between Europe and Asia.

- Through the canal, Israel aims to eliminate (Hamas in) Gaza to ensure economic opportunities, peace, and political stability (in Israel alone) in the region (Palestine-less Isreal)!

Challenges

- The planned route is over 100 km longer than the Suez Canal.

- The canal’s military focus could potentially hamper trade in the region.

{GS2 – MoCAFPD – Schemes} Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY)

- Context (TH | PIB): The GoI is providing food grains free of cost to the Antyodaya Anna Yojana households and Priority Households beneficiaries under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY).

- The decision has been taken to strengthen the provisions of the National Food Security Act, 2013.

- PMGKAY is operated by the Ministry of Consumer Affairs, Food and Public Distribution.

- Objective: To feed the poorest citizens of India by providing free grain through the Public Distribution System to all eligible households under the National Food Security Act (NFSA) 2013.

- PMGKAY will subsume the two subsidy schemes of the Department of Food & Public Distribution:

- Food Subsidy to Food Corporation of India (FCI) – For centralised procurement by FCI.

- Food Subsidy for decentralized procurement by states.

- Eligible households: Primary Households (PHH) and Antodaya Anna Yojana (AAY) households under NFSA, 2013.

Provision under NFSA

- Free Foodgrain: Rice, wheat, and coarse grains for a period of one year (Jan 2023 – Dec 2023).

- Quantity: 35 kg per Antyoday Anna Yojana Household and 5kg per person to a Priority Household (as under NFSA, 2013).

PMGKY Vs. NFSA, 2013

- Under NFSA, 2013, beneficiaries pay subsidised prices called Central Issue Price (CIP) worth Rs.1, Rs.2, and Rs.3 for coarse grains, wheat, and rice, respectively.

- Under PMGKY foodgrains are provided free of cost.

Merger of PM-GKAY and NFSA

- In 2022, PMGKAY was merged with NFSA and extended until December 2023.

- Under this merger, the entire food grains under PM-GKAY and NFSA were made free of cost.

National Food Security Act, 2013

- Coverage and entitlement under Targeted Public Distribution System (TPDS)

- It covers 50% of the urban population and 75% of the rural population.

- Uniform entitlement of 5 kg per person per month.

- Food at subsidised prices: Rs. 3/2/1 per kg for rice, wheat, and coarse grains.

- However, the poorest of the poor households will continue to receive 35 kg per household per month under Antyodaya Anna Yojana (AAY).

- Identification of Households to be done by States/UTs under TDPS determined for each State.

- For the purpose of issuing ration cards, the eldest woman of the household of age 18 years or above is to be the head of the household.

- The Act provides for food security allowance in case of non-supply of entitled foodgrains or meals.

Coverage

- The free nutritious meal to pregnant women and lactating mothers and children up to 6 years of age under the Integrated Child Development Services (ICDS) scheme.

- The free nutritious meal to children in the 6-14 age group under the Mid-Day Meal Scheme.

- Pregnant women and lactating mothers will receive a maternity benefit of Rs. 6,000.

{GS2 – MoHA – Laws} Bharatiya Nagarik Suraksha Sanhita (BNSS) Bill, 2023

- Context (TH): A report published by the Parliamentary Standing Committee held that the BNSS Bill introduces safeguards to prevent the registration of cases against Armed Forces personnel for acts performed in the ‘line of duty’ without the prior consent of the Union/State govt.

- The proposed provision will be in addition to the Armed Forces Special Powers Act (AFSPA) that gives unbridled power to the armed powers deployed in ‘disturbed areas.’

- The CrPC protects the armed forces only from arrest, and there are no conditions regarding the registration of criminal cases.

Bharatiya Nagarik Suraksha Sanhita (BNSS) Bill, 2023 > August 2023 Monthly CA Magazine.

{GS2 – MoLE – Schemes} Employee State Insurance (ESI) Scheme

- Context (PIB): The recent provisional payroll data of the Employee State Insurance (ESI) scheme revealed that 18.88 lakh new employees were added in the month of September.

- The ESI scheme is a self-financed integrated measure of Social Insurance embodied in the Employee State Insurance Act.

- The scheme is administered by the Employee State Insurance Corporation (ESIC), an autonomous corporation under the Ministry of Labour and Employment (MoLE).

Coverage

- The ESI scheme is designed for non-seasonal factories (factories and other establishments like Hospitals, Roads, Cinemas, etc) employing 10 or more persons.

- However, the threshold limit for coverage of establishments is still 20 employees in some states.

Eligibility

- The scheme covers all factory or establishment employees with a salary of up to Rs. 21,000 per month.

- This limit is Rs. 25,000 per month for persons with disabilities.

- Contributions: Employees contribute 0.75% of the wages, whereas employers contribute 3.25% of the wages payable to their employees.

- The contributions are made monthly at a fixed percentage of wages.

- Employees earning < Rs. 137/- a day are exempted from payment of their share of contribution.

- The scheme is implemented on a district-wise basis.

- Benefits to the employees include medical, sickness, disablement (temporary and permanent), maternity, funeral expenses, and other benefits as provided by the Act.

{GS2 – MoRD – Schemes} Digital India Land Records Modernization Programme

- Context (PIB): The Department of Land Resources has presented Abhinandan Patras to Gram Panchayats of Tribal Districts under the first leg of the Vikshit Bharat Sankalp Yatra.

- Digital India Land Records Modernization Programme is a Central Sector scheme, earlier known as the National Land Record Modernisation Programme (NLRMP).

- It is implemented by the Department of Land Resources, Ministry of Rural Development.

- Objectives:

- To develop a modern, comprehensive, and transparent land record management system.

- To develop an Integrated Land Information Management System (ILIMS) across India.

- Major components:

- Computerization of land records.

- Computerization of Registration.

- Digitization of Cadastral Maps.

- Linkage of RoR (Record of Rights) with cadastral maps.

- Modern Record Room.

- Integration of Registration with Land Records.

SAMVITA Scheme

|

{GS2 – MoTA – Schemes} PM-PVTGs Development Mission

- Context (PIB): PM launched the Pradhan Mantri Particularly Vulnerable Tribal Groups (PM-PVTGs) Development Mission.

- PM-PVTGs aims to improve the socio-economic conditions of the particularly vulnerable tribal groups (PVTGs) by saturating PVTG families and habitations with basic facilities such as:

- Safe housing

- Clean drinking water and sanitation

- Improved access to education

- Health and nutrition

- Road and telecom connectivity

- Sustainable livelihood opportunities

- Under the scheme, several ministries will collaborate to implement development projects. The schemes include Pradhan Mantri Gram Sadak Yojana, Pradhan Mantri Gramin Awas Yojana, and Jal Jeevan Mission, among others.

- The Ministry of Tribal Affairs (MoTA) is the Nodal Ministry for overall policy planning and coordination of programs for the development of STs.

Particularly Vulnerable Tribal Groups (PVTGs)

- PVTGs are a more vulnerable group among tribal groups in India.

- These groups have primitive traits, geographical isolation, low literacy, zero to negative population growth rate and backwardness.

- They largely depend upon hunting and a pre-agriculture level of technology.

- In 1973, the Dhebar Commission set up a separate category for Primitive Tribal Groups (PTGs).

- In 1975, the Centre identified 52 tribal groups as PTGs. In 1993, 23 more groups were added to the list.

- In 2006, these groups were named Particularly Vulnerable Tribal Groups (PVTGs).

Population of PVTGs

- Currently, 2.8 million PVTGs belong to 75 tribes across 18 states and UTs in India.

- According to the 2011 Census, Odisha has the largest population of PVTGs, followed by Madhya Pradesh and Andhra Pradesh (including Telangana).

- The largest PVTG is Odisha’s Saura community, numbering 535,000.

Schemes implemented by the MoTA for socio-economic development of STs

|

{GS2 – Polity – IC – FRs} Right to Privacy: Seizure of Digital Devices

- Context (TH): The SC expressed concern over the arbitrary seizure of digital devices and asked the Centre to frame guidelines to govern such actions by agencies.

The legal Position

- Journalists do not have any legal protection against the seizure of their digital devices.

- Under Sec 165 of CrPC, if there are reasonable grounds, the police can search devices during a probe.

- Section 102 of CrPC gives police the power to seize any property that may be found under circumstances that create suspicion of the commission of the offense.

- The IT Act of 2000 mandates the creation of a hash value for electronic evidence before forensic analysis, ensuring its integrity.

|

SC’s Position

- The SC, in many cases, upheld the importance of a journalist’s device.

- In 2022, a Delhi court held that an investigating agency has no right to seek the password of the electronic device of an accused without their consent.

- In July 2023, the Kerala HC said that the police cannot seize a journalist’s phone in connection with a case without following the due procedure.

- In November 2023, the SC asked the Centre to frame guidelines to govern the seizure of individuals’ devices, particularly media professionals.

Issues

- Tampering: In many seizures, journalists were not provided with hash values. Officers can plant files on a device without the owner’s knowledge.

- Confidentiality at Risk: It’s possible that seized devices could be used to identify journalists’ sources.

- Affects the personal life: Officers often ask journalists to provide passwords to their work and personal accounts.

- Affects professional life: Many journalists record shows or write articles on their phones.

- Press Freedom Infringement: Actions against journalists infringe on the freedom of the press.

|

Way Forward

- The press is considered the fourth pillar of democracy, and if it can’t function independently, it will harm the foundations of our democracy.

- Excessive government powers without proper guidelines would be dangerous. Therefore, GoI must formulate guidelines to govern the seizure of devices, with an emphasis on safeguarding privacy.

- The guidelines must include the following key elements:

- Judicial Warrants: Law enforcement agencies should be permitted to seize or search devices without a prior judicial warrant specifying the information sought.

- Protection: Journalists should not be compelled to provide passcodes/biometric data.

- Data Safeguards: Ensure the security of devices and data, preventing leaks, tampering, or unauthorized sharing.

{GS2 – Polity – IC – Reservation} Sub-categorisation of SCs

- Context (TH): PM announced the formation of a committee to consider sub-categorization of the Madiga community within the Scheduled Castes (SC) in Telangana.

- The Chinnaiah case did not allow governments to introduce sub-quotas for the more backward SCs and STs.

- In the Chinnaiah case (2005), the SC said that:

- The governments cannot introduce a sub-quota within the SC and ST quota in favour of a few castes or tribes more backward than others on the list.

- The SC said that the object of Article 341 of IC was to eliminate political factors in the identification of SCs, and the government had no power to “disturb” the presidential list.

- It was held that the SCs and STs specified in their respective lists form a class by themselves, and regrouping or reclassifying them violates the Constitution.

- The state government does not have the power to sub-classify SCs.

- Under Article 341 of IC, the President notifies a list of SCs for each state, which can thereafter only be modified by Parliament and not the state legislature.

- Since the state government could not add or remove a caste from the list, it could not allot separate sub-quotas to various castes in the list either.

- In Davinder Singh’s case (2020), the SC disagreed with the Chinnaiah case verdict and referred the issue to a larger bench for reconsideration.

|

Commission for sub-categorisation of SCs

- A national commission was constituted by GoI to examine the issue of sub-categorisation of SCs in Andhra Pradesh.

- The commission submitted its report in May 2008 recommending amendment of Article 341 of the Constitution to provide for sub-categorisation of SCs.

States’ opposition to the sub-categorisation

- In 2020, fourteen states have opposed the Centre’s proposal to sub-categorise SCs and only seven have supported the move.

Backwardness Data

|

Way Forward

- Treating the entire list of SCs in a state as a homogenous category and presuming that each caste within the list was as backwards as the other SCs is not correct.

- There are several castes included within the presidential list of SCs in a state, but some of them may be ahead of others.

- Hence, sub-classification within the SC community:

- Ensures equal distribution of benefits to every community.

- Prevents the dominant community from monopolizing them.

Sub-classification of OBCs

|

{GS2 – Vulnerable Sections – STs} Community Rights and Forest Conservation

- Context (TH): Forest Conservation (Amendment) Act, 2023 (FCA 2023) has undermined the community rights of the indigenous forest dwellers.

Community Rights

- Community rights refer to a community or group’s collective rights and interests.

- They recognize the rights of communities to:

- self-determination

- self-governance

- control over their own resources and development

- They are based on the understanding that communities are more than just groups of individuals; they are distinct entities with unique identities, cultures, and interests.

Importance of Community Rights

- Self-determination and empowerment

- Protection from exploitation and marginalization

- Sustainable resource management

- Preservation of cultural heritage

- Promotes social justice

- Environmental protection

- Conflict resolution and peacebuilding

- Reduction in man-animal conflict

How FCA 2023 Undermines Community Rights?

Exempting Forest Lands from the Purview of the Act

- The Act adds more activities that are excluded from the restriction on dereservation, such as:

- zoos and safaris under the Wild Life (Protection) Act, 1972, owned by the government or any authority, in forest areas other than protected areas

- eco-tourism facilities

- silvicultural operations (enhancing forest growth)

- any other purpose specified by the GoI

- The Act will now apply exclusively to areas categorized under the Indian Forest Act of 1927 and those designated as such on or after October 25, 1980.

- The Act exempts certain types of land from the provisions of forest law. They include:

- Forest land along government-maintained rail lines or public roads, providing access to habitation or rail, with roadside amenities, up to a maximum size of 0.10 hectares.

- Forest land within 100 km along international borders, LOC, or LAC, intended for strategic projects of national importance or security construction

- Forest land up to 10 hectares earmarked for security-related infrastructure construction

- Forest land designated for defense projects, paramilitary force camps, or specified public utility projects by the GoI (limited to 5 hectares in left-wing extremism-affected areas)

- Forest land converted to non-forest use on or before December 12, 1996

Removal of the Requirement of Prior Consent from Gram Sabha

- The FCA underwent crucial amendments in 2016 and 2017, which made prior consent from tribal gram sabhas mandatory for any forest alterations for non-forest purposes.

- However, FCA 2023 have removed the necessity for such consent.

- In this context, State governments can engage gram sabhas in land acquisition for various purposes through State-level steering committees within the existing framework.

- But many state governments may hesitate, perceiving Adivasi gram sabhas as anti-development and impeding economically beneficial afforestation initiatives.

Flawed Compensatory Afforestation

- FCA 2023 makes the land transfer for compensatory afforestation easy.

- But it does not specify the trees that should be planted.

- Generally, monoculture is practiced in compensatory afforestation, which leads to biodiversity loss.

- Moreover, it will not serve the communities who have suffered from the cutting down of the forest.

Issues with the Forest Rights Act (FRA)

- Forest Rights Act of 2006 provides for the restitution of deprived forest rights across India.

- Tt aims to integrate conservation and livelihood rights of the people.

- Despite initial enthusiasm, Central and State governments seem less inclined to implement the FRA in their respective states.

- Reasons for lack of enthusiasm:

- Many see the Act as a barrier to converting forest land for non-forest purposes.

- The state government and its bureaucracy believe that granting community rights under the FRA could weaken the state’s authority over the forest.

- Now, the dilution of FCA, rather than amending the FRA, further limits claims of Adivasi rights.

Way Ahead

- FCA should be amended in a way where the conservation of forests/biodiversity and community rights of indigenous people should be the priority.

- Economic gains from forests can be pursued without compromising biodiversity and community rights.

- Synchronicity between FCA and FRA should be developed to preserve community rights.

{GS3 – IE – Inflation} Indian Rupee Depreciation

- Context (IE | LM | IE): Rupee depreciation negatively impacted petroleum product imports, but its positively impacted petroleum product exports from India.

- Rupee depreciation is the decline in the value of the Indian rupee against other foreign currencies, particularly the US dollar. This means that it takes more rupees to buy one dollar.

- Rupee depreciation can have a significant impact on the Indian economy, both positive and negative.

Reasons of Rupee Depreciation

- Trade Imbalance: Increased demand for foreign currencies for imports can pressure the domestic currency, leading to depreciation.

- Inflation Differentials: Higher inflation than trading partners erodes a country’s currency purchasing power.

- Interest Rates: Lowering interest rates by a country’s central bank can make its currency less attractive to investors seeking higher returns, leading to depreciation.

- Speculation: If traders and investors anticipate that a currency will weaken in the future, they may sell it in large volumes, causing its value to decline.

- Political and Economic Stability: Political instability, economic uncertainty, or financial crises can undermine investor confidence, leading to currency depreciation in a country.

- External Debt: As external debt needs to be serviced and repaid in foreign currencies, the demand for those currencies increases, leading to depreciation of the domestic currency.

- Global Economic Conditions: Factors such as global economic slowdowns, financial crises, or geopolitical tensions can impact currency values.

Impacts of Rupee Depreciation

Positive Impacts of Rupee Depreciation

- Export competitiveness: A weaker rupee makes Indian goods and services more competitively priced in international markets.

- Boosts tourism: Cheaper travel expenses due to a weaker rupee can boost tourism revenue.

- Higher remittances: A weaker rupee increases the value of remittances.

- Balance of Payments: Higher export earnings and reduced imports due to increased prices can improve the country’s balance of payments.

Negative Impacts of Rupee Depreciation

- Increased debt burden: When the rupee depreciates, the cost of repaying these loans increases.

- Inflation: The increased cost of imports combined with other factors contribute to inflation.

- Trade deficit concerns: A weaker rupee may boost exports but raises concerns about a widening trade deficit if higher export earnings are offset by increased import costs.

- Higher import costs

- Reduced purchasing power

- Volatility and uncertainty in financial markets

Why Indian Rupee is Depreciating in 2023

- Capital outflows: Due to the high US dollar yields, investors are pulling out money from domestic markets and investing in the US market for higher returns.

- The surge of US dollar was driven by investors seeking safe havens amidst concerns about:

- a potential global recession

- rising inflation in various countries

- ongoing war in Ukraine

- The surge of US dollar was driven by investors seeking safe havens amidst concerns about:

- Inflation pressures: High inflation exerts a notable downward pressure on a country’s currency value.

- India’s retail inflation, which is measured by consumer price index (CPI) surged to a 15-month high of 7.44% in July 2023, up from 4.81% in June.

|

{GS3 – IE – Securities} Sahara Group Scam

- Context (IE): Recently, the Sahara Group founder Subrata Roy died. Sahara Group faced multiple legal battles with his group firms accused of circumventing regulations with Ponzi schemes.

Subrata Roy

- Subrata Roy was the founder of Sahara India Group. He expanded the group’s operations across various sectors, including finance, real estate, media, entertainment, tourism, healthcare, and hospitality.

- His career was marked by legal issues, notably his involvement in the Sahara-SEBI case related to financial irregularities.

- This led to his arrest in 2014 for failing to appear before the SC in a legal dispute with the Securities and Exchange Board of India (SEBI).

Sahara-SEBI Case

- In 2008, two unlisted Sahara group companies, with paid-up capital of less than $20,000 each, raised funds from millions of small investors through Optionally Fully Convertible Debentures (OFCDs).

- SEBI’s Ruling: In 2010, SEBI ruled that the fund-raising process of Sahara did not comply with the SEBI rules and ordered the group companies to refund the money to the investors, with 15% annual interest.

- Sahara Group’s Stand: The group claimed that the money raised through “optionally convertible debentures” would not come under the SEBI jurisdiction as they are “privately placed.”

- SEBI contended that a private placement should be for a maximum of fifty investors, not millions.

|

|

Appeal against SEBI’s Ruling

- The ruling of SEBI was challenged before the Securities Appellate Tribunal (SAT), which was upheld.

- SC upheld the SAT ruling and ordered Sahara Group to deposit the money in 3 installments.

- To facilitate the repayment, the Sahara-SEBI escrow account was established.

- In 2013, SEBI issued orders to attach the group’s bank accounts and other properties after companies failed to pay the remaining two installments.

- In March 2023, SC directed Rs. 5000 Crores to be transferred out of the “Sahara-SEBI Refund (Escrow) Account” to the Central Registrar of Cooperative Societies (CRCS).

- Accordingly, the CRCS-Sahara Refund Portal has been developed by GoI to facilitate the refund process for crores of depositors who had invested money in the fraudulent Sahara Group’s firms.

|

|

Citizenship of Subrata Roy’s Wife and Son

- On account of multiple cases against Roy’s family, his wife and son gave up on Indian Citizenship.

- They took the citizenship of Macedonia (a land-locked country in South-Eastern Europe).

- To acquire the citizenship of Macedonia, a person must declare an investment of 4 lakh Euros and employ 10 local people to acquire Macedonian citizenship.

{GS3 – S&T – AI} Humane AI Pin: World’s First Displayless Smartphone

- Context (IE | IT | TOI): Humane AI Pin is the world’s first displayless smartphone developed by Humane, a start-up by former Apple employees.

AI Pin

- The AI Pin is a screenless wearable device that is attached to your clothes with a magnet.

- Using AI technology it performs various funtions that a smartphone does.

- It can project a screen which you can use just like a smartphone.

- Advantage of AI Pin: Small and lightweight

Concerns with AI Pin

- Privacy and security

- Reliability and functionality

- Price and value

{GS3 – S&T – ISRO} NISAR Mission

- Context (TH): Key tests, including the thermal vacuum testing, will be conducted before the launch of NASA-ISRO SAR (NISAR) in 2024.

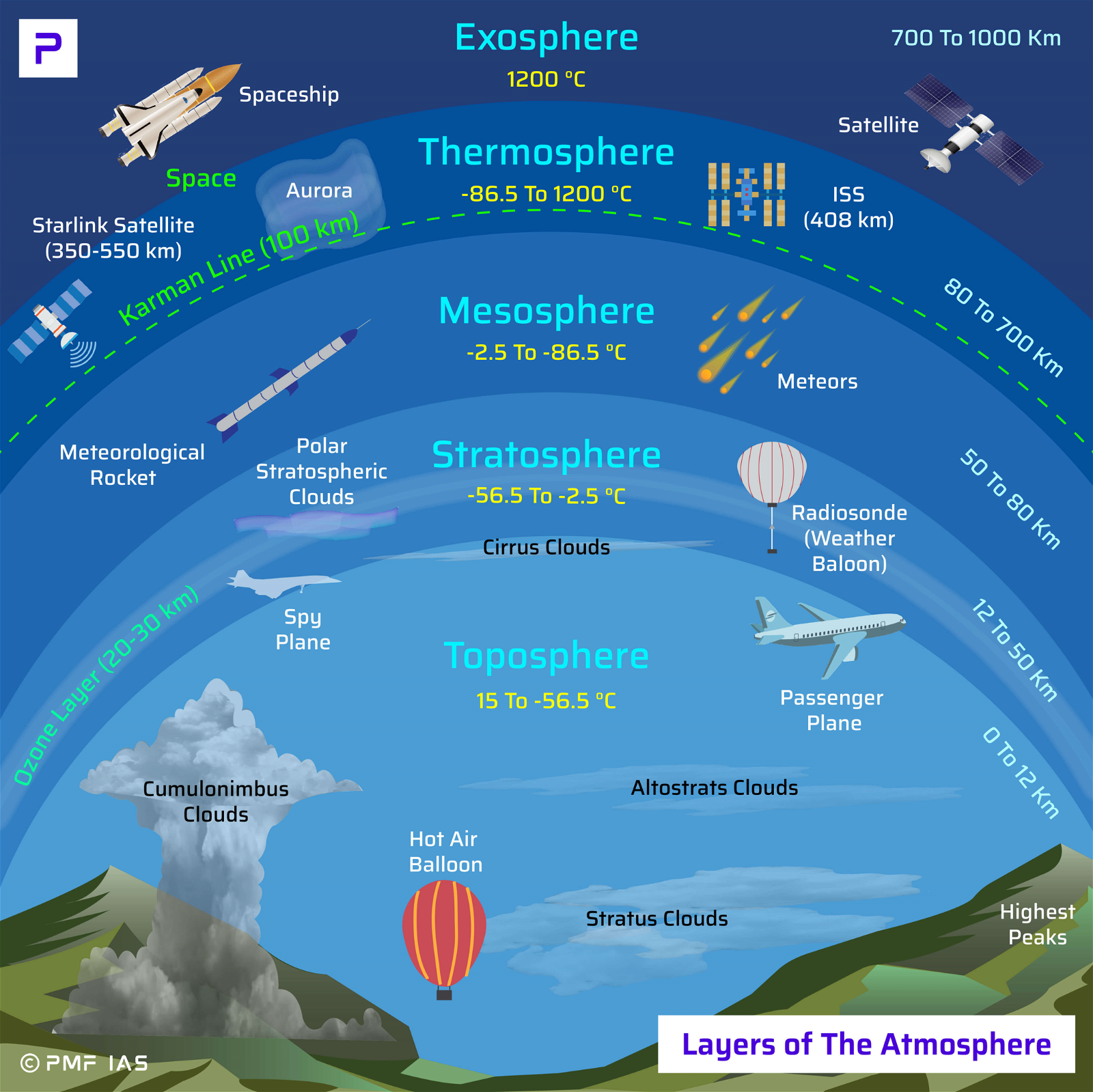

- NISAR is a Low Earth Orbit (LEO) observatory jointly developed by NASA and ISRO.

- It will be launched onboard ISRO’s GSLV Mark-II launch vehicle.

- It will map the entire globe in 12 days.

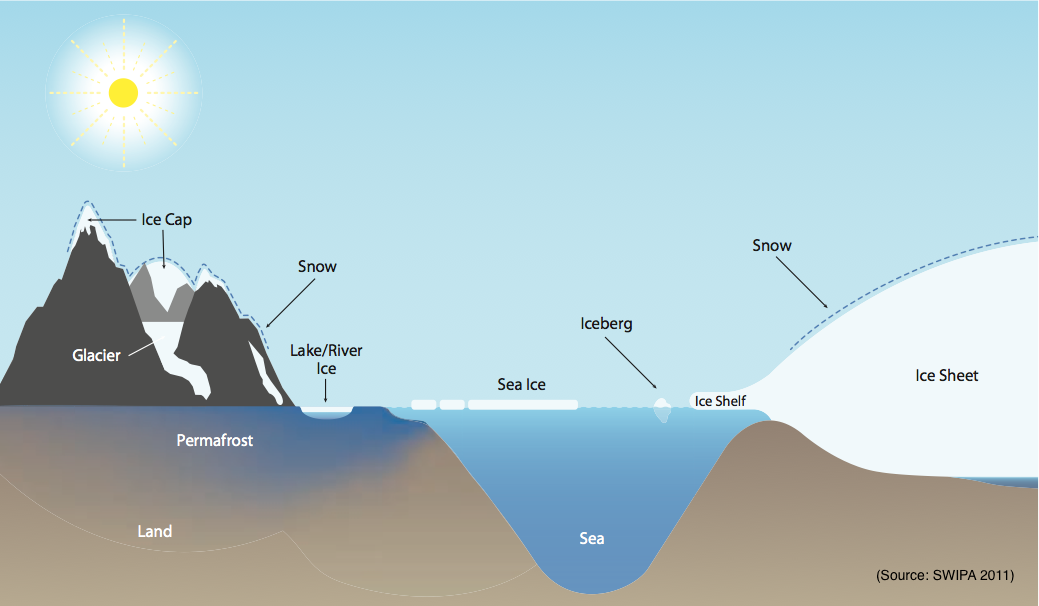

- It will help understand changes in Earth’s ecosystems, ice mass, vegetation biomass, sea level rise, groundwater, and natural hazards (like earthquakes, tsunamis, volcanoes, and landslides).

- It carries a Synthetic Aperture Radar (SAR), which operates with the Sweep SAR technique.

- The SAR payloads mounted on the Integrated Radar Instrument Structure (IRIS) and the spacecraft bus are called an observatory.

|

Synthetic Aperture Radar (SAR)

- SAR uses radar antenna motion to generate a synthetic aperture, surpassing the size of the physical antenna.

- It works by transmitting pulses of microwave energy towards the Earth’s surface.

- The energy reflected back to the radar is then analyzed to create an image of the surface.

Advantages of SAR

- All-weather operation: Can operate in clouds and rain.

- High-resolution imaging: Image resolution depends on the synthetic aperture size, dictated by the radar’s flight path length.

- Day and night operation: It uses its own illumination source, not dependent on sunlight.

- Long-range operation: Because microwaves can travel long distances through the atmosphere.

- Wide range of applications: Used in environmental monitoring, military applications, agriculture, oceanography, and geology.

- Penetration of vegetation and soil.

- Ability to measure surface properties.

Sweep SAR

- NISAR’s deployable antenna will operate in a unique mode called Sweep SAR.

- When it transmits microwaves, the radar’s signal feed is stationary, producing a narrow beam of microwave energy.

- But when it receives the returning signal, the radar feed sweeps its beam across the antenna’s reflector.

- Sweep SAR employs a one-dimensional phased-array feed of evenly spaced, individually controllable radar antennas arranged in rows.

- Advantages of Sweep SAR:

- High-resolution image

- Wide area coverage (swath >240km)

|

![PMF IAS Environment for UPSC 2022-23 [paperback] PMF IAS [Nov 30, 2021]…](https://pmfias.b-cdn.net/wp-content/uploads/2024/04/pmfiasenvironmentforupsc2022-23paperbackpmfiasnov302021.jpg)