Current Affairs November 02, 2023: Open Market Operation, Groundwater in India, Endosulfan, Dedicated Freight Corridor, Doctrine of Pleasure

Subscribers of "Current Affairs" course can Download Daily Current Affairs in PDF/DOC

Subscribe to Never Miss an Important Update! Assured Discounts on New Products!

Must Join PMF IAS Telegram Channel & PMF IAS History Telegram Channel

{GS1 – Geo – EG – Water Resources} Groundwater in India

- Context (IE): A report published by United Nations University has warned that 27 of the 31 aquifers in India are depleting faster than they can be replenished.

- India is the world’s largest groundwater extractor, surpassing China and the US combined.

- As per the Central Ground Water Board, 70% of India’s water comes from groundwater sources.

Reasons for Groundwater Depletion

- Agricultural overexploitation: Agriculture accounts for over 80% of groundwater use in India.

- Inadequate regulation: The Mihir Shah Committee highlighted a lack of focus on institutional innovations in the water sector.

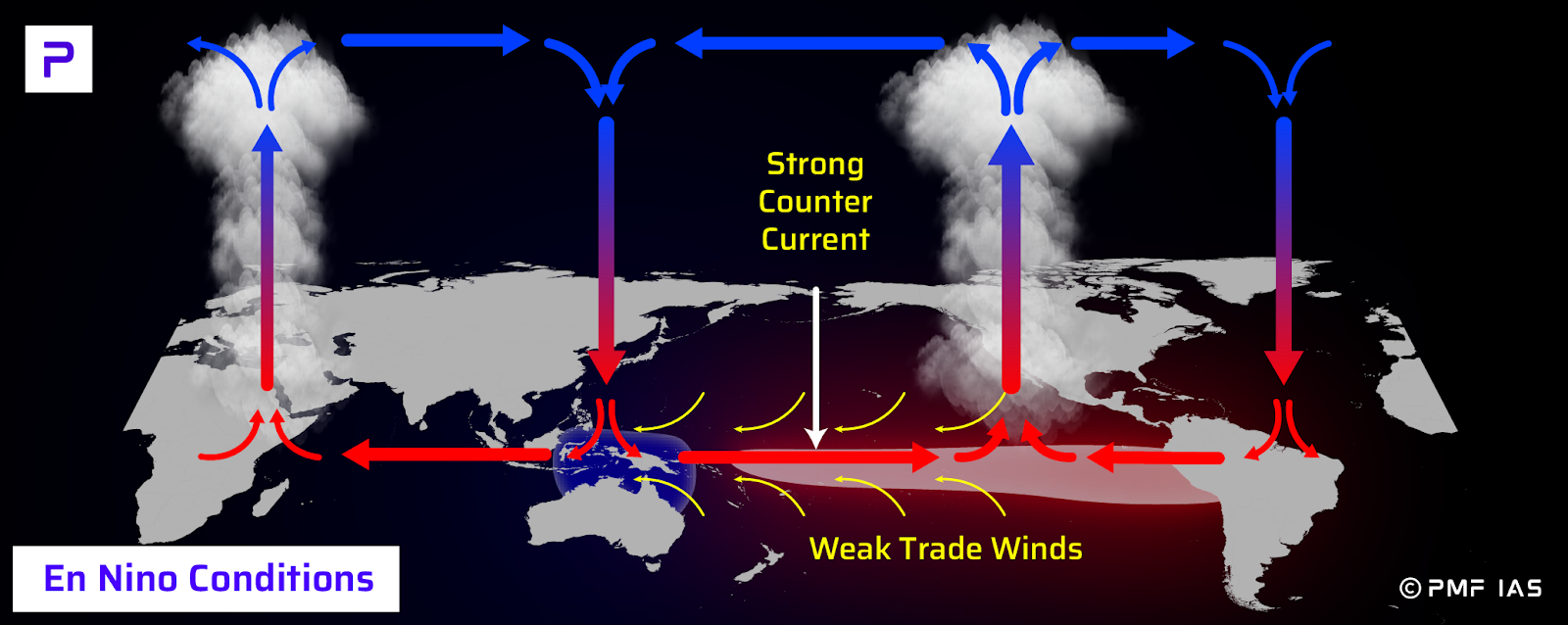

- Climate change: Droughts and rising temperatures are causing decreased rainfall and increased evaporation, reducing aquifer recharge.

- Urbanisation: Urbanization creates more impervious surfaces, limiting groundwater recharge.

- Deforestation: It causes more soil erosion and less rainfall infiltration.

- Subsidies on electricity and water

- Population growth

Government Initiatives for Groundwater Conservation

Atal Bhujal Yojana (ABY)

- Atal Bhujal Yojana (ABY) is a central sector scheme of the Ministry of Jal Shakti.

- Aim: to improve groundwater management through community participation.

- It will be implemented in priority areas across seven states: Gujarat, Haryana, Karnataka, MP, Maharashtra, Rajasthan, and UP.

- It is funded by the GoI and the World Bank on a 50:50 basis.

Jal Shakti Abhiyan: Catch the Rain

- Catch the Rain is an annual campaign under Jal Shakti Abhiyan.

- Aim: to encourage people to adopt rainwater harvesting practices.

|

National Aquifer Mapping and Management Programme (NAQUIM)

- NAQUIM is implemented by the Central Ground Water Board (CGWB).

- It is a part of the Ground Water Management and Regulation Scheme (a central sector scheme)

- Objectives of NAQUIM are:

- Delineation & characterisation of aquifers in 3D to understand their disposition

- Identification & quantification of groundwater issues

- Development of groundwater management plans

- Objectives of NAQUIM are:

Pradhan Mantri Krishi Sinchayee Yojana (PMKSY)

- PMKSY is a centrally sponsored scheme launched in 2015 by the Ministry of Jal Shakti.

- Aims:

- To enhance physical access to water on the farm

- To expand cultivable area under assured irrigation

- To improve on-farm water use efficiency

- To introduce sustainable water conservation practices

- The main components of PMKSY are:

- Accelerated Irrigation Benefit Programme (AIBP)

- Har Khet Ko Pani (HKKP): It has four sub-components.

- Command Area Development (CAD)

- Surface Minor Irrigation (SMI)

- Repair, Renovation and Restoration (RRR) of Water Bodies

- Ground Water Development

- Watershed Development

- Per Drop More Crop

- The Central and State Governments share funds under the scheme at a 60:40 ratio, except for the North Eastern and Himalayan states, where the ratio is 90:10.

{GS2 – Health – Issues} Endosulfan: The spray of death

- Context (TH): Conservationists in the Nilgiris warn of biodiversity threats from drone pesticide spraying. They have cited of the aerial spraying of Endosulfan in Kasargod, Kerala.

Endosulfan and Kasargod Tragedy

- Endosulfan is a organochlorine pesticide used in agriculture to control pests and diseases on crops.

- It was also used in non-agricultural settings to control pests such as mosquitoes and tsetse flies.

- It is a highly toxic chemical and has been linked to several serious health problems.

- In Kasargod, aerial spraying of Endosulfan in the cashew plantations began as early as 1976.

- It resulted in widespread contamination of the environment.

- This led to several severe health problems in local residents, including:

- Birth defects

- Neurological disorders

- Cancer

- Reproductive problems

- Skin diseases

Ban on Endosulfan

- Kerala Government banned the use of Endosulfan in 2005.

- In 2011, Stockholm Convention on Persistent Organic Pollutants (POP’s) placed a global ban on the manufacture and use of endosulfan.

- In the 2011, the Supreme Court of India also banned its use, manufacture and distribution.

Relief and Remediation

- In 2017, the SC directed the Kerala Government to pay Rupees 500 Crores to over 5,000 victims of the Endosulfan tragedy.

Stockholm Convention on Persistent Organic Pollutants (POPs)

Persistent Organic Pollutants (POPs)

|

{GS2 – MoR – Initiatives} Freight Business of Indian Railway (IR)

- Context (TH): Railways are most suited for large volumes of bulky materials over long distances. Rail freight movement is cost-effective, reliable, fast, and environmentally friendly.

|

Modes of Transportation

Railway Gauges

Broad gauge (74%) > Meter gauge (21%) > Narrow gauge (5%) Operating Ratio

|

Initiatives to boost Infrastructure Investment in IR

- PM Gati Shakti (PMGS) policy for a National Master Plan (NMP): It aims to bring synergy to create a seamless multi-modal transport network in India.

- National Logistics Policy (NLP): It focuses on building a national logistics portal and integrating the platforms of various ministries.

Increasing Bulk Cargo

- The IR’s freight segment is profitable, whereas the passenger segment makes huge losses.

- The profit from freight traffic is nullified in cross-subsidising passenger services.

- To increase revenue, IR is trying to boost its freight volumes.

GoI’s Initiatives for Increasing Bulk Cargo

- Relaxed block rake movement rules to provide a facility to load from/to multiple locations.

- Permitted mini rakes.

- Introduced private freight terminals (PFTs).

- Relaxed conditions in private sidings.

Issues of IR

- Rising debt: IR’s passenger segment makes huge losses.

- Reducing the share of the railway in bulk cargo (trucks doing the job inefficient supply chain high costs as well as more carbon emissions)

- High logistic cost (due to long waiting times and inefficient operations)

Ways to Increase Freight Business

- Develop common-user facilities at cargo aggregation/dispersal points in mining, industrial & cities.

- Reduce non-price barriers for cargo transport.

- The IR must also look at new commodities like fly ash. The IR approved many power plant sidings without fly ash loading facilities. IR must proactively correct this wrong.

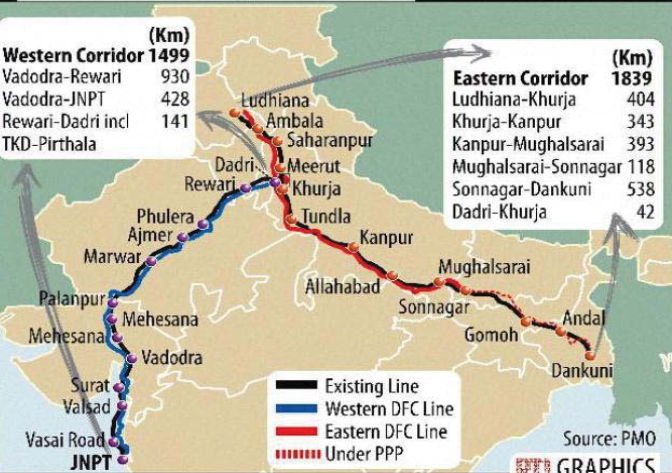

Dedicated Freight (Commercial Goods Movement) Corridor (DFC)

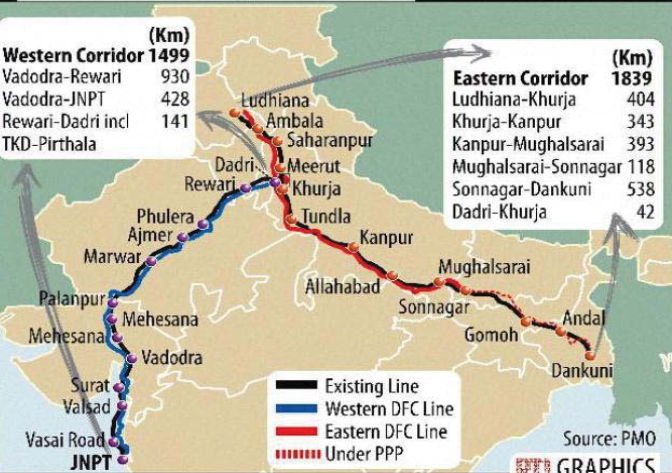

- Dedicated Freight Corridor (DFC) comprises the construction of two dedicated freight corridors:

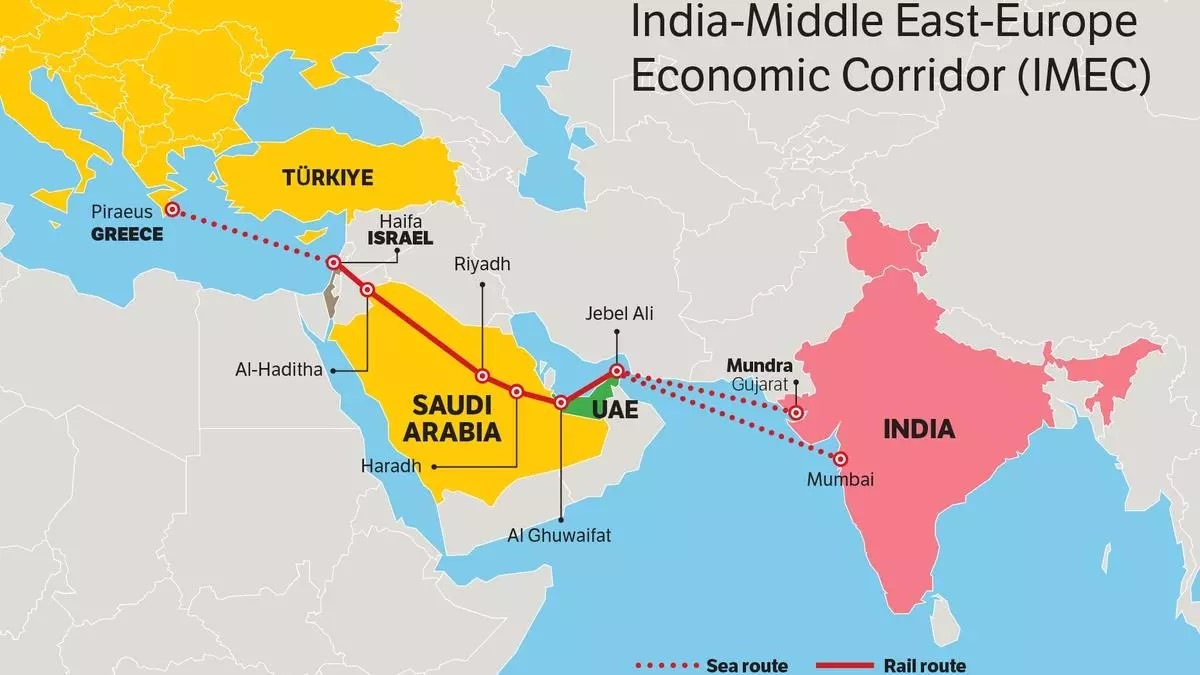

- Western Corridor (JNPT to Dadri) (1506 km): Runs between Dadri, Uttar Pradesh and the JNPT port in Mumbai.

- Eastern Corridor (Dankuni to Ludhiana) (1875 km): Runs between Ludhiana, Punjab and Dankuni, West Bengal near Kolkata.

Need of DFCs

- The Indian Railways network is heavily tilted in favour of passenger traffic, increasing the logistic cost (goods trains have to stay idle to make way for passenger trains wasted man-hours, high transportation costs) and making Indian products uncompetitive in the global market.

- To make the supply chain efficient, the GoI is emphasizing freight rail infrastructure by constructing DFCs nationwide.

|

Benefits of DFCs

- Creates additional rail transport capacity.

- Improve operational efficiency.

- Reduce cost of operation.

- Carry higher volumes of freight traffic.

- Decongesting Indian roads.

- Saving foreign exchange by reducing diesel imports.

Major initiatives of the Indian railways

|

{GS2 – Polity – IC – President} Doctrine of Pleasure

- Context (IE): President Murmu has terminated the services of an Indian Army Major posted with a Strategic Forces Command (SFC) unit.

- The President exercised powers under Section 18 of the Army Act, 1950 and Article 310 of IC.

The Strategic Forces Command (SFC)/Strategic Nuclear Command

- It is a part of India’s Nuclear Command Authority (NCA), which is responsible for command, control and making operational decisions regarding the country’s nuclear weapons.

- It is a tri-service command organisation constituted by GoI in 2003.

- It handles the country’s tactical and strategic nuclear weapon stockpile.

- It is responsible for operationalising the directives of the NCA under the guidance of a three-star rank officer, a Commander-in-Chief.

|

Army Act of 1950

- The Army Act of 1950 governs the functioning, administration, and discipline within the Indian Army.

- This act covers various aspects, including the structure of the army, terms of service, legal provisions for discipline, and the trial process for military personnel.

- Section 18: every person subject to this act holds office during the pleasure of the President.

Article 310 of IC

- Unless otherwise stated in this Constitution:

- Anyone in the defence or civil services of the Union or holding posts related to the defence or civil service of the Union holds the office during the pleasure of the President.

- Anyone in the civil services of the State or holding posts related to the civil service of the State holds the office during the pleasure of the Governor.

- This is subject to the provisions of IC and hence does not apply to:

- Judges of the SC

- Judges of the HC

- Chief Election Commissioner (CEC)

- Comptroller and Auditor General of India (CAG)

Doctrine of Pleasure

- This idea was developed in England. In England, the civil services are considered part of the Executive, with the Crown serving as its head.

- According to the theory of pleasure, the Crown has the authority to fire civil workers without giving them notice of termination. That is, they serve at the discretion of the Crown.

- Public servants are not entitled to pursue legal action against the Crown for wrongful termination when terminated.

Position of Doctrine of Pleasure in India

- Under Article 310 of IC, the President has the authority to dismiss a civil servant or a member of defense forces at any time because he serves as the Executive Head of the Union.

- Article 310 of the IC is not absolute, and the same applies to this concept. This concept is, therefore, subject to constitutional provisions and not infallible.

Related Constitutional ProvisionsArticle 52 of IC

Article 53 of IC

|

{GS3 – Envi – RE} White Hydrogen

- White hydrogen deposits are also found in the US, Russia, Oman, France, Mali, Australia, etc.

- White hydrogen (also called natural gold or geologic hydrogen) is a naturally occurring form of hydrogen found in the Earth’s crust.

Advantages of White Hydrogen

- It is carbon neutral, i.e., it causes no greenhouse gas emissions when used as a fuel.

- It is compatible with existing hydrogen infrastructure and technologies.

- It is cheaper and more efficient.

- It is abundant and renewable (RE) in nature.

Other Types of Hydrogen

|

{GS3 – IE – RBI} Open Market Operation (OMO)

- OMO is a monetary policy tool central banks use to control money supply and interest rates.

- OMO involves the purchasing and selling of government securities (G-Sec) in the open market.

Government Securities (G-Sec)

|

How OMO Works

- When a central bank buys G-Secs, it injects money/liquidity into the economy.

- When the central bank sells G-Secs, it drains money/liquidity from the economy.

Economic Goals for Which OMOs are Used

- Controlling the money supply

- Influencing interest rates

- Stabilising financial markets

- Implementation of monetary policy

- Exchange rate management

- Signaling monetary policy intentions in future

- Supporting government debt management

Types of OMO

Permanent OMO

- Permanent OMO involves the outright purchase or sale of G-Secs.

- This implies the central bank permanently holds the securities it buys or sells.

- It is typically used to achieve long-term monetary policy goals.

Temporary OMO

- Temporary OMO involves the repurchase (repo) or reverse repurchase (reverse repo) of G-Secs.

- In a repo, the central bank buys G-Secs with an agreement to sell them back on a future date at a predetermined price.

- In a reverse repo, the central bank sells G-Secs with an agreement to repurchase them at a predetermined price on a future date.

- Temporary OMO is used for managing liquidity and short-term interest rates.

Concerns with OMO

- Market Distortions: Large-scale OMOs can distort bond market prices, making it hard for market participants to assess actual values.

- Financial Bubbles: Central bank G-Sec purchases (infuses liquidity) can lower interest rates, making investing in assets (like stocks and real estate) more appealing. If asset prices rise too high (bubble), they can crash and cause a financial crisis.

- Unintended Consequences: For e.g., buying government securities to lower interest rates may misallocate capital or encourage excessive borrowing and leverage.

- Liquidity Risk: Central banks may face liquidity risks when selling large volumes of G-Secs because:

- Market participants fearing central bank support withdrawal can cause market disruptions.

- Selling many securities can drive down prices and hinder others from trading them.

- Central banks may struggle to sell all desired securities.

- Market Dependency: Financial markets expecting continuous central bank intervention for stability can reduce market self-regulation.

- Income Inequality: Central bank asset price stimulation through OMOs can benefit wealthier individuals, worsening wealth disparities.

- Long-Term Effects: E.g., creating a low-interest rate environment, which can influence investment decisions, pension funds, and the behaviour of savers.

- Balance Sheet Risks: A central bank holding many G-Secs faces risk if interest rates rise or the securities’ value falls.

Why is RBI Considering OMO Now?

- This de facto tightening of the economy doesn’t appear to target inflation.

- The actual reasons are:

- To curb the sharp rise in retail and personal loans

- To ease the pressure on Indian Rupee

Curbing the sharp rise in retail and personal loans

- There is a sharp rise in retail and personal loans despite surging interest rates.

- Concerns are raised over:

- Expanse and pace of credit growth to this segment

- Quality of borrowers availing loans

- Build-up of stress in this segment

- So, squeezing out liquidity and raising interest rates may slow this credit growth.

Concern

- Tightening financial conditions will affect not only consumer credit (buying unwanted stuff on EMI) but also industrial credit (which might adversely hit job creation).

Easing the pressure on Indian Rupee

- The dollar index has strengthened, notwithstanding daily fluctuations.

- So, currencies of both developed and emerging markets have come under pressure.

- In this scenario, OMOs help widen the spread between Indian and US bond yields, relieving pressure on the rupee.

Concern

- The pressure on the Indian Rupee is unlikely to abate quickly.

- A prolonged currency defence can hinder RBI/MPC’s response to domestic inflation and growth.

|

{GS3 – IE – Taxes} Goods and Services Tax

- Context (TH): October Goods and Services Tax (GST) revenue is ₹1.72 lakh cr.

- This is the second-highest collection ever since the introduction of GST in 2017.

- The highest monthly collection was Rs 1.87 lakh crore in April 2023.

|

{GS3 – S&T – Defense} Phase-out of MiG-21

- Context (TH | PIB): The Indian Air Force (IAF) replaced one more MiG-21 squadron with SU-30MKIs.

- Now, only two MiG-21 squadrons remain in service.

- MiG-21s will be fully replaced by indigenous Light Combat Aircraft (LCA) Mk1A by 2025.

What is MiG-21?

- The Mikoyan-Gurevich MiG 21 is a supersonic jet fighter and interceptor aircraft designed by the Mikoyan-Gurevich Design Bureau in the Soviet Union.

- It has participated in all major conflicts, including the 1965 and 1971 India-Pakistan wars and the 1999 Kargil conflict.

- India adopted the MiG-21 in 1963 and had the right to build it in the country.

- Russia ceased production in 1985, but India continued with upgraded versions.

Why Phase out of MiG-21?

- The MiG-21 earned the nickname “Flying Coffin” due to its high accident rate.

- In the past decade, there were 108 air accidents involving Indian military forces. Out of these, 21 crashes involved the MiG-21 Bison and its variants.

- The MiG-21 is a single-engine fighter, which can lead to crashes if the engine fails, as it needs time to restart, and if it’s too low, the pilot must eject.

Sukhoi Su-30MKI

- The Sukhoi Su-30MKI is a twin-seater, multirole, long-range fighter/bomber, air superiority Aircraft.

- It was developed by Russia’s Sukhoi Corporation in 1995 and built under licence by India’s Hindustan Aeronautics Limited (HAL).

- Range: 3000 Km

- Speed: Mach 2

Light Combat Aircraft (LCA) Tejas Mk-1A

- It is an Indian fighter aircraft developed by the Aeronautical Development Agency (Under Defence Research and Development Organisation) in partnership with HAL.

- It is a small, lightweight, single-engine, delta-wing aircraft and belongs to the class of contemporary supersonic combat aircraft.

- The project started in the 1980s as the LCA program to replace old MiG-21 fighters. In 2003, it was officially named “Tejas.“

- It is the second supersonic fighter jet developed by HAL (the first being the HAL HF-24 Marut).

{Prelims – Sci – Physics} Ghost Particles

- Context (IE): China to build the world’s largest ‘ghost particle’ detecting telescope named ‘Trident’ in the South China Sea.

|

- Neutrinos are nicknamed ghost particles because they are very difficult to detect.

- They are subatomic particles with little mass and no electric charge.

- They are among the most abundant and tiniest particles in our universe.

- Significance:

- Netrinos defy established rules of physics.

- Understanding their source will enable them to explain the origins of cosmic rays.

![PMF IAS Environment for UPSC 2022-23 [paperback] PMF IAS [Nov 30, 2021]…](https://pmfias.b-cdn.net/wp-content/uploads/2024/04/pmfiasenvironmentforupsc2022-23paperbackpmfiasnov302021.jpg)