Source of Funds for Panchayats

Subscribers of "Current Affairs" course can Download Daily Current Affairs in PDF/DOC

Subscribe to Never Miss an Important Update! Assured Discounts on New Products!

Must Join PMF IAS Telegram Channel & PMF IAS History Telegram Channel

- Context (IE): The RBI has recently published a report titled “Finances of Panchayati Raj Institutions” covering the years 2020-21 to 2022-23.

Sources of Funds for Panchayats

- Own source of funds (1. Tax revenue & 2. Non-Tax revenue)

| Tax revenue | Non-Tax revenue |

|

|

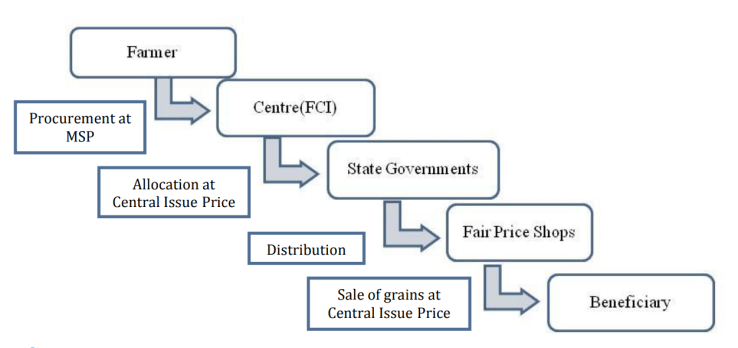

- Transfers from Union and State Governments

- The 73rd amendment of the constitution provides a provision that the state governments must constitute State Finance Commissions (SFCs) every five years.

- The SFC will make recommendations about the sharing of resources between the state and the local bodies (both rural and urban).

- Grants received to carry out activities as part of national schemes. For example, under the 15th Finance Commission’s period, panchayats are to receive funds to implement a Centrally Sponsored Scheme known as ‘Jal Jeevan Mission’.

Key Finding of the report

- Panchayats’ Own Sources of Revenue i.e. tax revenue is very limited. The own revenues of the Panchayats were only 1.1 per cent of their total revenue during the study period.

- Non-tax revenue, primarily from Panchayati Raj programmes and interest earnings, constituted 3.3 per cent of the total revenue receipts.

- The average revenue per Panchayat (encompassing taxes, non-taxes, and grants) was at approx. 21 lakhs for the three consecutive periods of 2021,2022,2023.

- Average Expenditure witnessed a decline from 17.3 lakh in 2020-21 to 12.5 lakh in 2022-23, attributed to elevated spending during the pandemic year.

- There are sharp inter-state variations in the devolution of powers and functions to Panchayats.

- States having higher devolution levels exhibit better outcomes in health, education, infrastructure development, water supply and sanitation.

- Issue: Around 95 per cent of their revenue come in the form of grants from higher levels of government.

- This restricts their spending ability that is already hampered by delays in the constitution of State Finance Commissions.

- Over 2.5 lakh Panchayati Raj Institutions (PRIs) utilised the eGramSwaraj platform for accounting purposes.

- Additionally, more than 2.4 lakh PRIs have seamlessly integrated the eGramSwaraj-PFMS Interface for online transactions, facilitating online payments.

![PMF IAS Environment for UPSC 2022-23 [paperback] PMF IAS [Nov 30, 2021]…](https://pmfias.b-cdn.net/wp-content/uploads/2024/04/pmfiasenvironmentforupsc2022-23paperbackpmfiasnov302021.jpg)