Issues in Financial Devolution

Subscribers of "Current Affairs" course can Download Daily Current Affairs in PDF/DOC

Subscribe to Never Miss an Important Update! Assured Discounts on New Products!

Must Join PMF IAS Telegram Channel & PMF IAS History Telegram Channel

- Context (TH): Recently, various States, especially from south India, have claimed that they have not been receiving their fair share compared to their contribution in tax collection as per the present scheme of financial devolution.

What is divisible pool of taxes?

- It refers to the distribution of net tax proceeds between the Union government and the States as outlined in Article 270 of the Constitution.

- Shared taxes include corporation tax, personal income tax, Central GST, and the Centre’s share of IGST.

- Apart from the share of taxes, States are also provided grants-in-aid as per the recommendation of the FC.

- Notably, cess and surcharge imposed by the Centre are not part of the divisible pool.

FC composition & Qualification

- The President of India constitutes the Finance Commission every fifth year or earlier under Article 280 of the Constitution.

- It consists of a chairman and four other members who are appointed by the President.

- The Finance Commission (Miscellaneous Provisions) Act, 1951 specifies the qualifications for the chairman and other members of the commission.

- It makes recommendations on the distribution of financial resources between the Union and the states.

- The Union government has notified the constitution of the 16th Finance Commission under the chairmanship of Dr Arvind Panagariya for making its recommendations for the period of 2026-31.

What is the basis for allocation?

- The share of States from the divisible pool (vertical devolution) stands at 41% as per the recommendation of the 15th FC.

- The distribution among the States (horizontal devolution) is based on various criteria. (See the figure below)

What are the issues?

- Firstly, cess and surcharge, estimated at around 23% of its gross tax receipts, are not shared with the States.

- The total tax revenue for the years 2022-23 (actual), 2023-24 (revised estimates) and 2024-25 (Budget estimates) of the Union government is (₹30.5, ₹34.4, and ₹38.8 lakh crore), respectively.

- The State’s share was (₹9.5, ₹11.0, and ₹12.2 lakh crore), respectively, which constitutes around 32% of the total tax receipts of the Centre. This is way less than the 41% recommended by the 15th FC.

- Cess, like the GST compensation cess, is also used for centrally sponsored schemes that benefit the States. However, the States have no control over these components.

- Secondly, the amount each State gets back for every rupee they contribute to Central taxes shows steep variation.

- Industrially developed states received much less than a rupee for every rupee they contributed against states like Uttar Pradesh and Bihar.

- This is because many corporations are headquartered in these state capitals, where they would remit their direct taxes, and there is a difference in GST collection among various states.

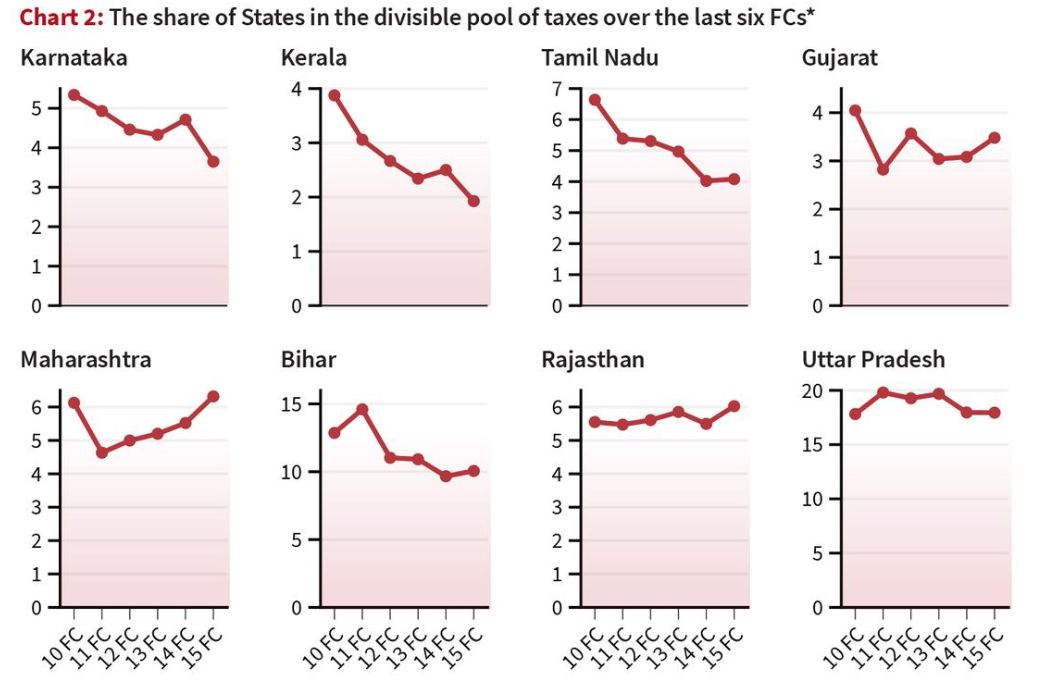

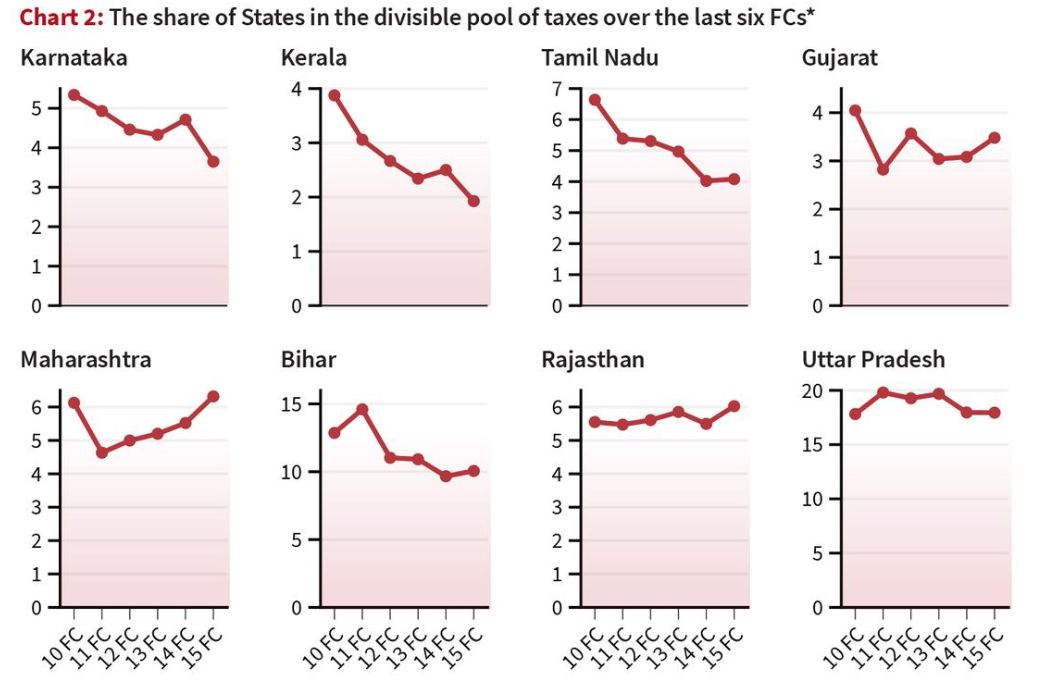

- Thirdly, the percentage share in the divisible pool of taxes has been reducing for southern States over the last six FCs.

- This is due to the higher weightage being given to equity (income gap) and needs (population, area, and forest) than efficiency (demographic performance and tax effort).

- Finally, grants-in-aid varies among various States.

- As per the 15th FC, there are revenue deficits, sector-specific and State-specific grants given to various States, and grants to local bodies. It is based on population and area of States.

Way forward

- It is the responsibility of all States to contribute towards the more equitable development of our country.

- However, the reforms suggested below may be considered for maintaining the balance between equity and federalism while sharing revenue.

- Suggested reforms

- The divisible pool can be enlarged by including some portion of cess and surcharge in it.

- The Centre should also gradually discontinue various cesses and surcharges it imposes by suitably rationalising the tax slabs.

- The weightage for efficiency criteria in horizontal devolution should be increased.

- Relative GST contribution from States can be included as a criterion by providing suitable weightage in future FCs.

- Like the GST council, a more formal arrangement for the participation of States in the constitution and the working of the FC should be considered.

- States generate around 40% of the revenue and bear around 60% of the expenditure. The FC and its recommendations should assess this imbalance and propose a fair sharing mechanism.

- It is also imperative that the States uphold principles of fiscal federalism by devolving adequate resources to local bodies.

![PMF IAS Environment for UPSC 2022-23 [paperback] PMF IAS [Nov 30, 2021]…](https://pmfias.b-cdn.net/wp-content/uploads/2024/04/pmfiasenvironmentforupsc2022-23paperbackpmfiasnov302021.jpg)