Current Affairs November 25, 2023: Lachit Borphukan, Urban Co-operative Banks, 30 x 30 Target, Global Biodiversity Framework Fund, Insolvency and Bankruptcy Code, Sagarmala Project, Comprehensive Port Connectivity Plan, 3D Printing, National Milk Day, White Revolution in India

Subscribers of "Current Affairs" course can Download Daily Current Affairs in PDF/DOC

Subscribe to Never Miss an Important Update! Assured Discounts on New Products!

Must Join PMF IAS Telegram Channel & PMF IAS History Telegram Channel

{GS1 – MIH – Personalities} Lachit Borphukan

- Context (PIB): PM Modi has paid tributes to Lachit Borphukan.

- The Ahoms, under General Lachit Borphukan, defeated the Mughals in the Battle of Saraighat in 1671.

Battle of Saraighat

- It was a naval battle fought in 1671 between the Mughal Empire and the Ahom Kingdom on the Brahmaputra River at Saraighat, now in Guwahati, Assam.

- The weaker Ahom Army defeated the Mughal Army through diplomatic negotiations, guerrilla tactics, psychological warfare, and military intelligence.

Ahom Kingdom (1228–1826)

- The Ahom Dynasty ruled Assam and remained undefeated for nearly 600 years.

- It fell to repeated Burmese invasions of Assam.

- With the defeat of the Burmese after the First Anglo-Burmese War and the Treaty of Yandabo in 1826, control of the kingdom passed into the East India Company’s hands.

{GS2 – IE – Banking} Urban Co-operative Banks (UCBs)

- Context (IE): The Reserve Bank of India (RBI) superseded the Board of Abhyudaya Cooperative Bank for a year due to poor governance.

Urban Cooperative Banks (UCBs)

- UCBs are financial institutions that are registered as cooperative societies under the provision of either the State Cooperative Societies Act or the Multi-State Cooperative Societies Act.

- They provide banking services to urban and semi-urban areas, especially to low-income groups, small businesses, and self-employed people.

- Regulated by: RBI, Registrar of Cooperative Societies in each state (for overseeing UCBs).

- They are registered under the Cooperative Societies Act of the State concerned or the Multi-State Cooperative Societies Act, 2002.

- Governed by the Banking Regulations Act, 1949.

- They are based on the principles of Cooperation, mutual help, democratic decision-making, and open membership.

Bank’s Regulation in India

| Type of Bank | Regulator |

| Commercial (SBI, Axis) | RBI |

| Coop (Single State: Rural) | RBI + State Govt (dual regulation) |

| Coop (Single State: Urban) | RBI Only |

| Coop (Multi-State Cooperative) | RBI Only |

| Coop: Primary Agricultural Credit Societies (“PACS”) | State Govt |

UCBs Categorisation

- RBI based on the cooperativeness of the banks and availability of capital, had categorized UCBs into four tiers for regulatory purposes.

- RBI has also issued different regulatory guidelines for each tier to ensure financial stability and customer protection.

| Tier | Net Worth Requirement (Rs.) |

| Tier 1 | < 25 crore |

| Tier 2 | 25 crore or more but less than 100 crore |

| Tier 3 | 100 crore or more but less than 500 crore |

| Tier 4 | 500 crore or more |

- Minimum net worth: ₹2 crore for tier one UCBs operating in a single district and ₹5 crore for all other UCBs of all tiers.

- Capital Adequacy Ratio: 9% for tier one banks, for others- 12%.

|

Challenges faced by UCBs

- Poor governance due to inadequate oversight and accountability mechanisms.

- Lack of risk management leading to higher default rates and financial instability.

- Capital insufficiency due to smaller scale and limited reach.

- Lack of technology adoption.

- Lack of Professional Expertise.

- High NPAs due to inadequate credit assessment processes, poor loan recovery mechanisms, etc.

GoI Inititaitives for UCBs

- Amendment to the Banking Regulation Act to empower the RBI with enhanced regulatory powers over UCBs, allowing them to take prompt corrective action and address issues related to capital adequacy, asset quality, and risk management.

- New RBI guidelines allowed UCBs to raise capital through equity, preference shares, and debt instruments with the prior approval of RBI.

- Recapitalization bonds to assist UCBs in obtaining funding from the market.

- Enhanced Depositor Protection through DICGC Coverage.

- Establishment of the National Cooperative Development Corporation (NCDC) to provide financial support to UCBs.

- Supervisory Action Framework.

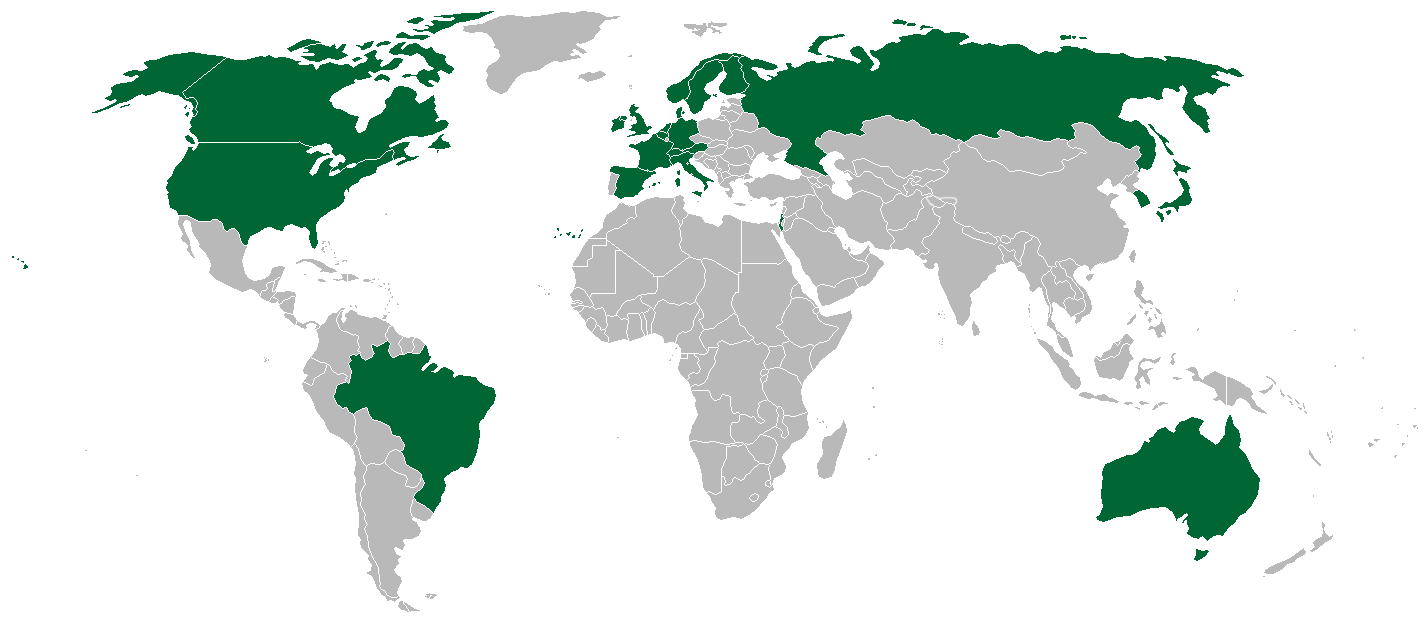

{GS3 – Envi – Conservation} 30 x 30 Target

- Context (DTE): The world is struggling to find enough space and funds to conserve its terrestrial and marine biodiversity under 30 x 30 target.

- The 30×30 target is a global initiative under which countries must at least 30% of their terrestrial, inland water, marine, and coastal areas by 2030.

- This ambitious target is a key component of the Kunming-Montreal Global Biodiversity Framework (KMGBF).

- The 30×30 target implies safeguarding a minimum of 30% of the Earth’s land and ocean to prevent biodiversity loss and address climate change.

Kunming-Montreal Global Biodiversity Framework (KMGBF)

|

What is Considered under 30% in 30×30 Target?

- Protected Areas.

- Other Effective area- based Conservation Measures or OECMs.

Protected Areas

- A Protected Area is a defined space managed through legal or effective means to ensure long-term conservation of nature, ecosystem services, and cultural values.

- It includes:

- National Parks

- Wildlife Sanctuaries

- Conservation Reserves

- Community Reserves

- Marine Protected Areas

Other Effective area- based Conservation Measures (OECMs)

- An OECM is a geographically defined area, other than a Protected Area, governed and managed to achieve positive and sustained outcomes for biodiversity conservation, including ecosystem functions, cultural values, and local relevance.

- OECMs complement protected areas through sustained, positive in-situ conservation outcomes, even though they may be managed primarily for other reasons.

Current Status of 30 x 30 Target

- Currently, 16.05% of the world’s land and inland waters and 8.17% of its oceans are protected areas.

- When existing OECMs are included, the share of protected areas rises to 17.23% for land and inland water and 8.28% for marine areas.

Role of Indigenous People

- Indigenous people and local communities manage over 32% of global land in 87 countries.

- KMGBF explicitly emphasises respecting the rights of indigenous peoples and local communities in pursuit of its conservation targets.

- Governments often neglect human rights, especially those of indigenous communities, in conservation projects or protected areas, even post-KMGBF.

- For e.g., The Maasai in Tanzania’s Serengeti ecosystem are marginalised and evicted from their ancestral lands for conservation projects, tourism, and trophy-hunting schemes.

- Indigenous people and local communities are indispensable for conservation because of their knowledge of cohabitation and biodiversity resources.

{GS3 – Envi – Conservation} Global Biodiversity Framework Fund

- Context (DTE): Global Biodiversity Framework Fund (GBFF), the world’s new biodiversity framework fund is without any real financial commitment to meet conservation targets.

- GBFF was established at the 7th Assembly of the Global Environment Facility (GEF).

- It will help countries achieve targets set under the Kunming-Montreal Global Biodiversity Framework (KMGBF).

Global Environment Facility (GEF)

|

Kunming-Montreal Global Biodiversity Framework (KMGBF)

|

Importance of Biodiversity Fund

- To protect the biodiversity which is at a crisis state at present.

- To achieve the biodiversity conservation targets like KMGBF.

- Due to inadequate funds, the world failed to meet Aichi Biodiversity Targets in 2020.

|

Can GBFF Adddress the Financial Needs of KMGBFF

- The world requires at least US $200 billion a year until 2030 to fund biodiversity protection programmes, as assessed during COP15.

- It can generate funds from private, philanthropic, and government investments.

- It will also have access to funds earmarked for biodiversity conservation under GEF.

- According to the “State of Finance for Nature”, there is a projected $4.1 trillion biodiversity financing gap by 2050.

- While it is too early to predict if GBFF would make a difference, the financial gap remains huge.

- If GBFF fails to find adequate money, countries will have to find more funds domestically, especially for developing countries.

|

Alternative Solutions to Raise Funds for GBFF

- Fees for the commercial use of digital genetic sequence information: Such information is crucial for developing products such as vaccines and hardy crop varieties.

- Solutions suggested by target 19 of KMGBF.

- Eliminate, phase out or reform subsidies harmful to biodiversity (target 18 of KMGBF): For e.g., farming subsidies are responsible for 14% of global deforestation.

Biodiversity Finance (Target 19 of KMGFF)

- Target 19 of KMGBF seeks a significant, incremental rise in accessible financial resources from all sources in an effective and timely manner.

- The suggested ways include:

- Increasing biodiversity-related international financial resources from developed countries

- Increasing domestic resource mobilisation through national biodiversity finance plans

- Leveraging private finance, promoting blended finance, etc.

- Innovative schemes such as payment for ecosystem services, green bonds, biodiversity offsets and credits, and benefit-sharing mechanisms with environmental and social safeguards

- Maximizing co-benefits and synergies in financing for biodiversity and climate crisis

- Enhancing the role of collective actions, including by indigenous people and local communities

- Enhancing the effectiveness, efficiency and transparency of resource provision and use

Blended Finance

|

|

Issues with Solutions Provided by Target 19 of KMGBF

- Developed countries and private sources are reluctant to provide biodiversity finance.

- Developing countries have capacity limitations for mobilising funds.

- Blended capital has not yielded the desired results so far.

- Solutions like green bonds, biodiversity credits, etc., are still in their infancy and have loopholes.

Way Forward

- Developed countries should take up responsibility and contribute to GBFF.

- Capacity building of developing countries for mobilising and utilising biodiversity finance.

- Loopholes associated with blended capital, green bonds, biodiversity credits, etc., should addressed to generate more funds through them.

{GS3 – IE – Bankruptcy/Insolvency} Insolvency and Bankruptcy Code (IBC)

- Context (TH): According to a recent report by CRISIL Rating, falling recovery rates and an increase in average resolution time have emerged as impediments to the success of Insolvency and Bankruptcy Code (IBC).

- IBC seeks to create a unified framework to resolve insolvency and bankruptcy in India.

- Objective: To resolve the bankruptcy crisis in the corporate sector, consolidate insolvency and bankruptcy proceedings, and revive the company in time time-bound manner.

- It is applicable to Individuals, Corporates, Partnerships, Limited Liability Partnerships, and personal guarantors to corporate debtors.

- Adjudicating authority: National Companies Law Tribunal (NCLT) for companies and LLPs and Debt Recovery Tribunals (DRTs) for individuals and Partnership firms.

- It provides for a time-bound process for resolving the insolvency of corporate debtors called the corporate insolvency resolution process (CIRP).

Insolvency Resolution Process

- Insolvency proceedings can be initiated either by the creditor (banks) or the loaner (defaulter).

- It is done by submitting a plea to the adjudicating authority, the National Companies Law Tribunal (NCLT).

- On acceptance of the plea, an Insolvency Resolution Professional is appointed.

- The power of management and board is transferred to the Committee on Creditors (CoC) (includes all financial creditors of a corporate debtor).

- The CoC will appoint and supervise the Insolvency Professional.

Institutional mechanism

- Insolvency Professionals (IPs): To conduct the resolution processes. These IPs will be members of Insolvency Professional Agencies (IPAs).

- Information Utilities (IUs): To collect/disseminate information to facilitate insolvency resolution.

- Regulator: Insolvency and Bankruptcy Board of India (IBBI) to regulate the functioning of IPs, IPAs and IUs.

- Adjudicators: For companies, the National Company Law Tribunal (NCLT) will adjudicate insolvency resolutions. For individuals, the Debt Recovery Tribunal (DRT) will adjudicate insolvency resolution.

- Committee of Creditors (CoC): It consists of financial creditors who will appoint and supervise the actions of IPs and approve the resolution plan.

Insolvency and Bankruptcy Board of India (IBBI)

Financial Creditors

Operational Creditors

|

Amendments

- The Insolvency and Bankruptcy Code (Amendment) Act, 2021 amended the Insolvency and Bankruptcy Code, 2016.

- It introduced an alternate insolvency resolution process for Micro, Small and Medium Enterprises (MSMEs) with defaults up to Rs 1 crore called the Pre-packaged Insolvency Resolution Process (PIRP).

- Unlike CIRP, PIRP may be initiated only by debtors.

- The debtor should have a base resolution plan in place.

- During PIRP, the management of the company will remain with the debtor.

Pre-Packaged Insolvency Resolution Process

Key features

|

Successes/Achievements of IBC

- Effective Recovery of Bad Debt: The average recovery rate under IBC has been 35-45%, compared with 25% through earlier mechanisms, strengthening the financial sheets of the banks.

- Comparatively Speedier resolution: The Standing Committee on Finance report (2021) noted that the time taken to resolve insolvency has reduced from 4.3 years to 1.6 years between 2017 and 2020.

- Attracting foreign investment due to improved investor confidence by providing improved recovery prospects.

- Promoting a creditor-centric approach by providing a clear hierarchy of claims to be settled and providing a structured mechanism for the resolution process.

- Promoting a culture of entrepreneurship by providing exit mechanisms for failed businesses and encouraging entrepreneurs to take calculated risks.

- NPA Resolution: According to RBI, IBC has been the most significant reform concerning NPA resolution.

Challenges of IBC

- Low recovery rates: Huge haircuts (large write-offs of loans) of as high as 95% point towards a deviation from the original objective of the code.

- Delays and Breach of Timelines: Though the average resolution timeline has come down, still more than 75% of the ongoing cases have been pending for over 270 days (the timeline stipulated in the Code).

- Limitation of DRTs/NCLT: Inadequate manpower (50% of posts in NCLT lying vacant), sluggish disposal of cases, huge pending cases, inadequate infrastructural facilities, etc.

- Poor infrastructure of the Information Utilities (IU) that provides access to credible and transparent evidence of default.

- Inadequate number of Insolvency Professionals (IPs) to manage the rising number of cases.

- Accountability of Committee of Creditors (CoC): Even though the CoCs have significant discretion in the resolution process, there is no mechanism to ensure accountability and transparency of its decisions.

Way Forward

- Provide funds and functionaries to DRTs and NCLT for timely disposal of cases.

- Leveraging greater expertise by appointing judicial members of NCLT at least at the level of High Court judges and specialised NCLT benches.

- Strengthen creditor rights by establishing a benchmark for haircuts, comparable to global standards.

- Capacity Building by training the lawyers, IPs, IPAs, and IUs to implement the law in its letter and spirit.

- End-to-end digitization of processes and improved data gathering by IUs to make the resolution process faster and maximize the realizable value of assets.

- Draft Framework for Cross Border Insolvency based on the UN Commission on International Trade Law (UNCITRAL) Model Law.

{GS3 – Infra – Ports} Sagarmala Project

- Context (TH | PIB): International Container Transhipment Port (ICTP), a Sagarmala Project, is being developed at Galathea Bay in the Great Nicobar Island.

- This hub is en route from East and NE India to East and SE Asia, Australia, and New Zealand.

- Once developed, travel time between Andaman and Kolkata ports will reduce from 72 to 15 hours.

What is Sagarmala Project?

- Sagarmala Project is the flagship Central Sector Scheme of the Ministry of Ports, Shipping and Waterways (MoPSW).

- It aims to foster port-led development in India by utilising its extensive 7,500 km coastline, 14,500 km of navigable waterways, and strategic position on crucial global maritime trade routes.

- The Union Cabinet approved the concept of Sagarmala in 2015.

- The vision is to reduce domestic and EXIM cargo logistics costs with optimised infrastructure investment.

- The five pillars of Sagarmala Project are:

- Port modernisation and new port development

- Port connectivity enhancement

- Port-led industrialisation

- Coastal community development

- Coastal shipping and Inland water transport

- Projects under Sagarmala are implemented by relevant Major Ports, Central Ministries, State Maritime Boards, State Governments, and other agencies.

National Technology Centre for Ports, Waterways and Coasts (NTCWPC)

- Under the Sagarmala Scheme, NTCWPC has been established in IIT Chennai.

- The institute acts as a technological arm of the MoPSW.

{GS3 – Infra – Scheme} Comprehensive Port Connectivity Plan (CPCP)

- Context (PIB): Under PM Gati Shakti, the Department for Promotion of Industry and Internal Trade (DPIIT) prepared a Comprehensive Port Connectivity Plan (CPCP).

- The CPCP was prepared in collaboration with the Ministry of Ports, Shipping and Waterways (MoPSW), Ministry of Railways (MoR), Ministry of Road Transport and Highways (MoRTH) and State Maritime Boards.

- CPCP incorporates road and rail projects along with port projects.

- These projects aim to enhance ports’ last mile and hinterland connectivity.

PM Gati Shakti – National Master Plan for Multi-modal Connectivity

- PM Gati Shakti is a digital platform that brings 16 ministries together for integrated planning and coordinated implementation of infrastructure connectivity projects.

- It will incorporate the infrastructure schemes of various Ministries and State Governments like Bharatmala, Sagarmala, inland waterways, dry/land ports, UDAN, etc.

Detail on PM Gati Shakti Scheme > PMF IAS CA August 2023 Monthly Compilation

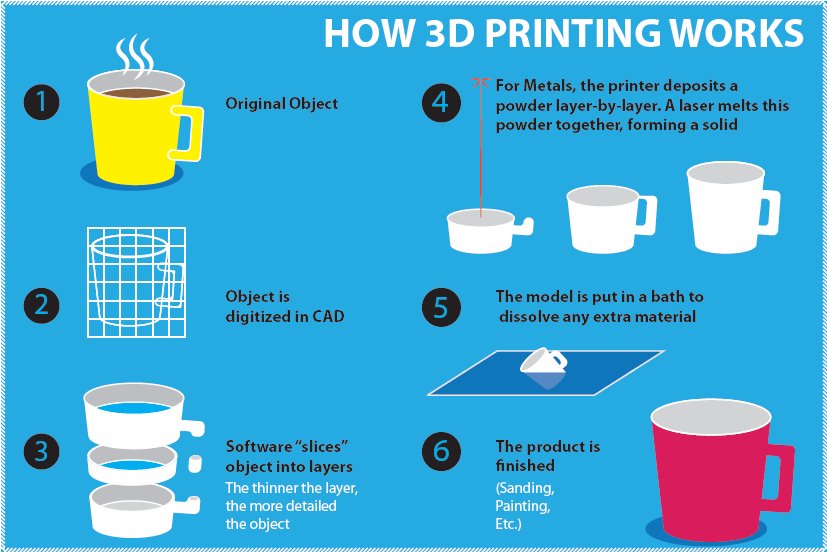

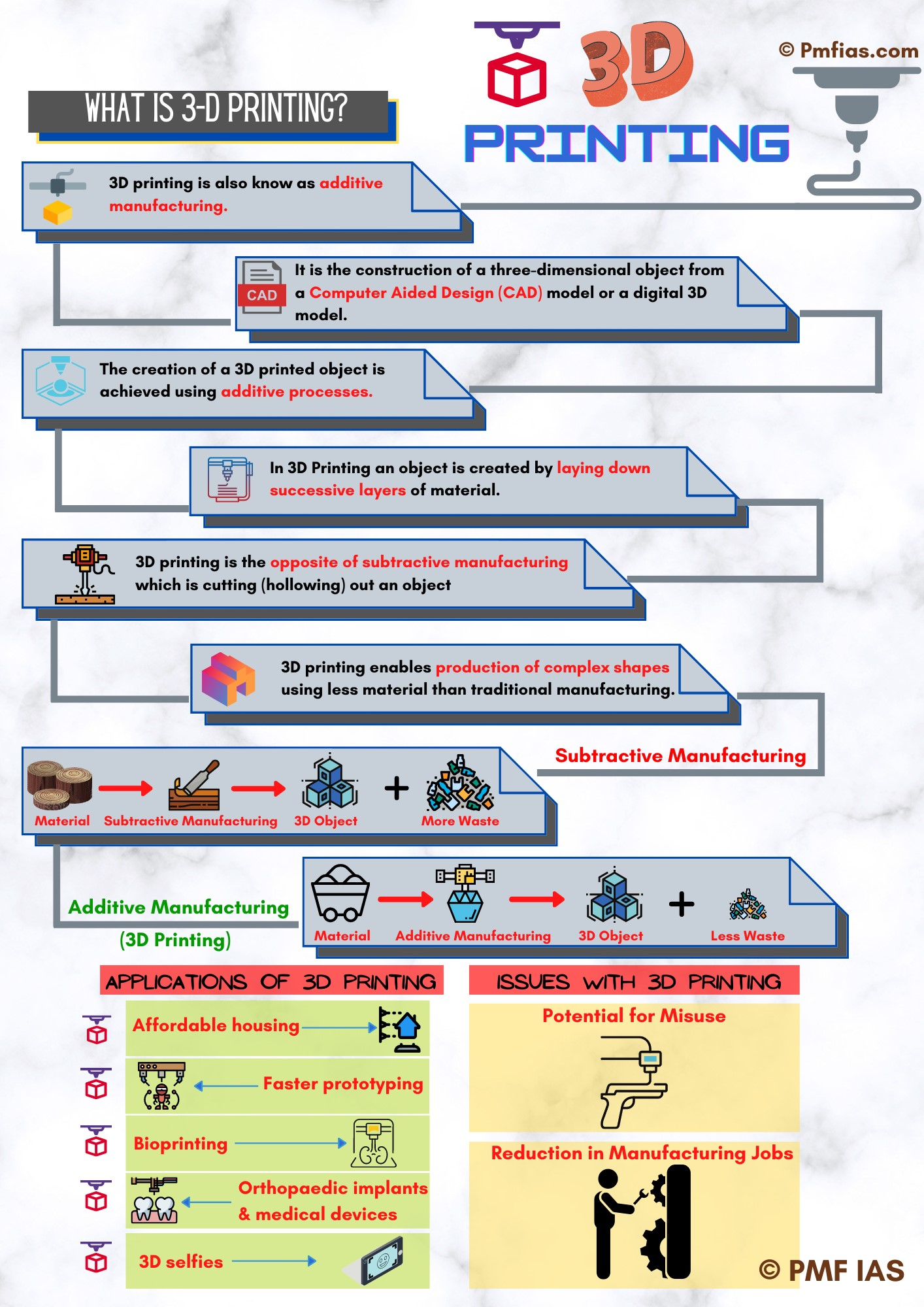

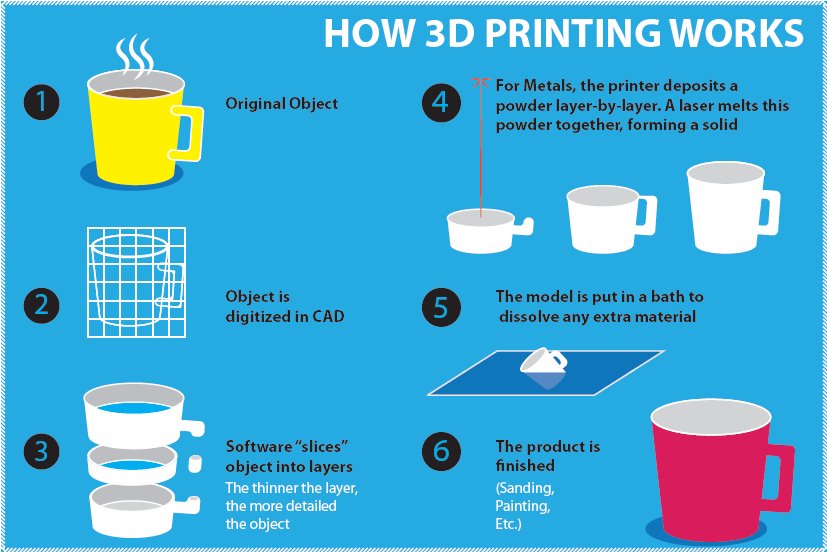

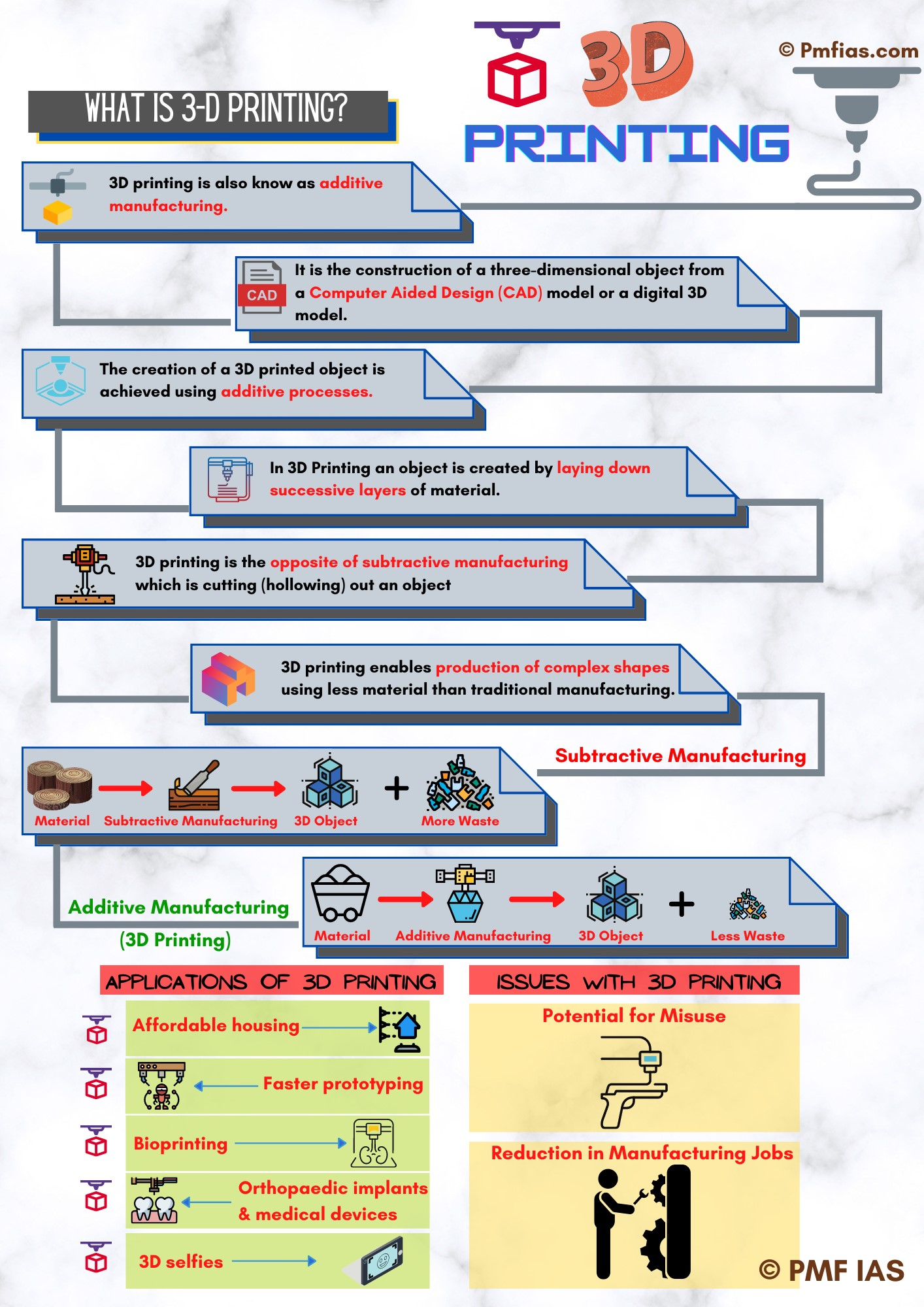

{GS3 – S&T – Tech} 3D Printing

- Context (IE): Researchers of IIT-Mandi have found a cost-effective alternative to metal 3D printing technology.

- 3D printing is a process of creating Three-dimensional objects from digital models by adding material layer by layer.

- It involves building up layers of materials like plastic, composites, or bio-materials to construct objects with varying shapes, sizes, rigidity, and colour.

- This process allows for more efficient and customized production compared to traditional subtractive manufacturing methods.

- Material used: Plastic, resin, thermoplastic, metal, fibre, or ceramic etc.

Application of 3-D printing

- Manufacturing: prototyping, tooling, end-use parts

- Medical: prosthetics, implants, tissue engineering

- Construction: architectural models, building components

- Aerospace: aircraft parts, rocket engines

- Automotive: car parts, engine components

- Fashion: jewelry, accessories, clothing

- Food: edible objects, food packaging

- Art: sculptures, figurines, jewelry

- Education: teaching tools, models, simulations

- Research: prototyping, testing, drug delivery

- Consumer: toys, gadgets, home goods

Advantages

- Faster production

- Flexible design

- Less wastage and cost-effective

- Environment-friendly process

- Better quality products

{Prelims – Agri – Misc} National Milk Day

- Context (PIB): National Gopal Ratna Awards has been conferred on the National Milk Day.

- National Milk Day is celebrated in India on November 26th each year.

- It is celebrated to commemorate the birth anniversary of Dr. Verghese Kurien (Milkman of India).

- He is called the Father of White Revolution in India.

White Revolution in India

- Also called Operation Flood, it started in the 1970s.

- It was the world’s biggest dairy development programme.

- It made India self–dependent in milk production.

National Gopal Ratna Awards

- It is one of the highest National Awards in the field of livestock and dairy sector.

- Its objective is to recognise and encourage all individuals who are associated in the dairy sector.

![PMF IAS Environment for UPSC 2022-23 [paperback] PMF IAS [Nov 30, 2021]…](https://pmfias.b-cdn.net/wp-content/uploads/2024/04/pmfiasenvironmentforupsc2022-23paperbackpmfiasnov302021.jpg)